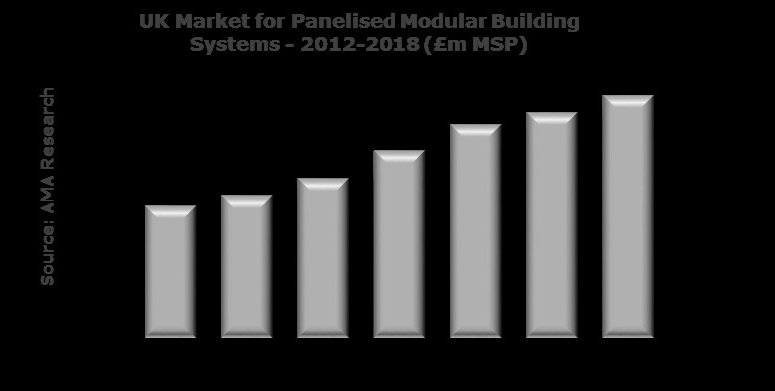

The UK panelised modular building systems market grows by 10% in 2015

The UK market for panelised modular building systems is estimated to have grown by 10% in 2015. Since the recent market low of 2012, demand for offsite building systems has increased strongly, underpinned by the improved economic situation and increased levels of activity in the housebuilding, hotel, student accommodation and education sectors. This recovery followed a downturn between 2008-12 due a decline in the housing market, cuts in public sector budgets and the completion of major MoD projects.

AMA Research’s definition of this market consists of pre-fabricated, 2-dimensional frames or panels in systems for constructing walls, partitions, roofs and floors, typically supplied to site as systems in flat-pack format. However, some systems, particularly light steel frame, are supplied to site in ‘stick’ form and/or direct to manufacturers of volumetric building systems. The main product type is timber frame, which is competing with light gauge steel, precast concrete and other engineered wood-based panels, with the latter group including structural insulated panels and cross laminated timber systems. While timber frame is currently the most widely used type of offsite systems in housing, it is expected to face competition from cross laminated timber over the next few years.

Key end use sectors for panelised modular building systems are housing, apartment blocks, schools, budget hotels, smaller healthcare and care facilities, and purpose built student accommodation. With the exception of the MoD, where many projects are now complete, most of the key end use sectors for panelised modular building systems look set for growth over the next few years and a number of housing developers and housing associations have declared their intentions to increase usage of offsite systems.

“Difficult market conditions in recent years had led to all sectors of the panelised building systems industry suffering a number of business failures, leading to a reduction in production capacities, and market supply has become much more polarised, in particular in the timber frame sector” said Keith Taylor, Director of AMA Research. “However, the market has improved since 2012 and further sustained recovery is expected until 2020, driven by improvements in key end use sectors such as housing – including self build, which is significant in this market”.

Growth over the next few years should also be enhanced by the mandatory use of Building Information Modelling on public sector projects from 2016. BIM will streamline building design, procurement and construction which should favour the use of offsite building. The drive towards sustainable development, coupled with the need to meet energy efficiency and carbon reduction targets, would also seem to weigh in favour of offsite construction.

In addition, some of the key drivers for offsite construction are coming back into focus, with recent announcements of a number of larger scale, repetitive construction programmes, in sectors such as university accommodation, social housing, affordable private sector housing and budget hotels.

The ‘Panelised Modular Building Systems Market Report – UK 2016-2020 Analysis’ report is published by AMA Research, a leading provider of market research and consultancy services with over 25 years’ experience within the construction and home improvement markets.

Leave a Reply

Want to join the discussion?Feel free to contribute!