Rinnai’s H3 range includes all mainstream varieties of renewable energy alternative options including, LOW-GWP heat pumps (4kw – 110kw) Hydrogen Blends 20% ready and BioLPG ready water heaters and boilers and market leading solar thermal. All options focus on creating decarbonisation pathways that are technically, practically and economically feasible based upon real life requirements. The H3 range is supported by in house design support along with carbon and cost modelling.

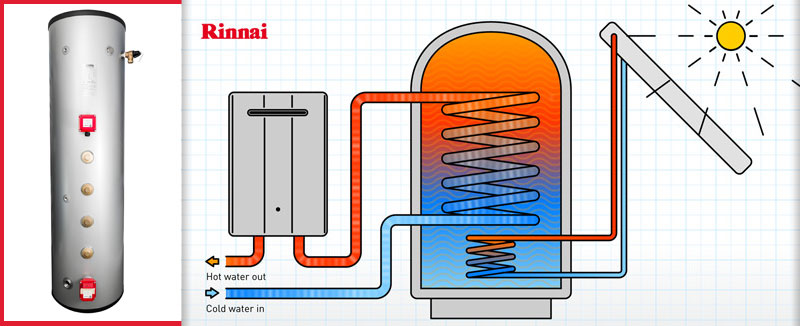

Rinnai can offer multiple avenues of cost reducing decarbonisation across various energy vectors. To create a healthier way of living, Rinnai is expanding customer choices in hot water provision as well as heating domestic and commercial buildings through a wide range of renewable energy systems. Rinnai’s solar thermal water heating systems are a market leading solution that saves up to 3.5x more carbon per m2 compared to conventional solar technology. This combined with the Rinnai Hydrogen and BioLPG ready condensing water heaters water heating system will save carbon and cost as the Rinnai water heaters will modulate from 58kw – 4.4kW dependent on the solar input therefore only using gas to boost the temperature when needed – harnessing renewable gains and not compromising on performance.

Core design values of Rinnai VirtuHOT solar thermal collectors have benefited from multiple workshops with experienced installers, whose valuable insights have been integrated into design and innovation. This has resulted in a system that is focussed on installer needs to simplify transportation, installation, and maintenance. From an in-life end user perspective the Rinnai VirtuHot system will deliver 50% greater financial returns per m2 in comparison to conventional solar technology, reducing ROI and saving energy and carbon in the process. The Rinnai condensing water heaters and VirtuHOT solar thermal array are backed with a warranty of up to 10 years to give additional peace of mind for installers and end users.

Rinnai intelligent condensing continuous flow water heaters can save more than 30% in operational running costs when compared to gas fired storage systems, helping to reduce fuel costs and exposure to ever-increasing energy and climate change legislation. All Rinnai & Naked Energy solar thermal products are precisely aligned with the hot water heating systems & units which are hydrogen blends-ready 20% and renewable liquid fuel (BioLPG and rDME) ready combustion technologies.

Rinnai’s H3 range of decarbonising products include commercial and domestic heat pumps that contain a variety of features: the HPIH range of commercial heat pumps is suited towards schools, restaurants, and small retail outlets. Rinnai’s HPIH Monobloc Air Source Heat Pumps – 21, 26, 28 & 32kW range can allow for up to seven units to be cascaded together or operate alone as one unit. Once joined together – can serve increased demand for heating and hot water.

The HPIH series includes a range of controls and system peripherals which ensures that all technical machinations can be monitored. Rinnai’s HPIH commercial heat pumps also deploy the refrigerant – R32. The HPIH use maintains an ERP rating of A++ making this range of heat pumps an ideal economic and environmental option for new build and refurbishment projects.

Rinnai’s HPHP series of LOW GWP heat pumps range from 48kw – 70kw. State-of-the-art technology added in the injection process outperforms gas compression technology and ensures that even with outside temperatures of –25 Celsius, heating, and hot water of up to 60 + Celsius can still be delivered.

Rinnai’s HPI SL range models perform with ultra-low sound capability ensuring compatibility with areas that hold strict sound compliance standards. All units operate in three different modes: heating, cooling and DHW and include specific system programmes that enhance product performance in all modes.

Rinnai’s H3 range is supported by free training courses, CPDs, FREE design services and extensive warranty options

CLICK HERE FOR FURTHER DETAILS

RINNAI H3 PRODUCT ROADMAP TO LOWER CARBON AND NET ZERO DE-CARBONISATION

Rinnai’s product and service offering is based on H3- Hydrogen, Heating and Heat Pumps – which allows any site in either residential or commercial sites to maximise the energy efficiency and performance in striving for NetZero and Decarbonisation. Additionally, Rinnai is developing and introducing electrical formats to all existing product ranges within the next few months. Rinnai’s new “H3” range of products includes a wide selection of commercial heat pumps as well as hydrogen blends-ready and hybrid hot water heating systems.

Rinnai is a world leading manufacturer of hot water heaters and produces over two million units a year. The company operates on each of the five continents and the brand has gained an established reputation for high performance, robust cost efficiency and extended working lives.

Rinnai’s commercial and domestic hot water products offer a limitless supply of instantaneous temperature controlled hot water and all units are designed to align with present and future energy sources and accept either natural gas or hydrogen gas blends. Rinnai units are also suited for off-grid customers who require LPG and BioLPG or rDME.

Rinnai units are UKCA certified, A-rated water efficiency, accessed through multiple fuel options and are available for purchase 24/7, 365 days a year. Any unit can be delivered to any UK site within 24 hours. System design services are available if needed and cost comparison services are accessible to all customers who require further cost detail.

Rinnai’s Innovation Manifesto clearly outlines the path to carbon neutrality and maintains a pledge to fully decarbonize company operations by 2050. Rinnai will further support the global clean energy transition by introducing a wide variety of domestic heating options across multiple energy vectors.

Rinnai is committed to decarbonisation. Rinnai’s water heating products are all hydrogen-blends ready NOW including the world’s first 100% hydrogen powered water heater. Rinnai products also accept BioLPG capable of delivering NetZero carbon emissions. Rinnai offer comprehensive training courses and technical support in all aspects of the water heating industry. More information can be found on Rinnai’s website and its “Help Me Choose” webpage.

CLICK HERE For more information on the RINNAI product range