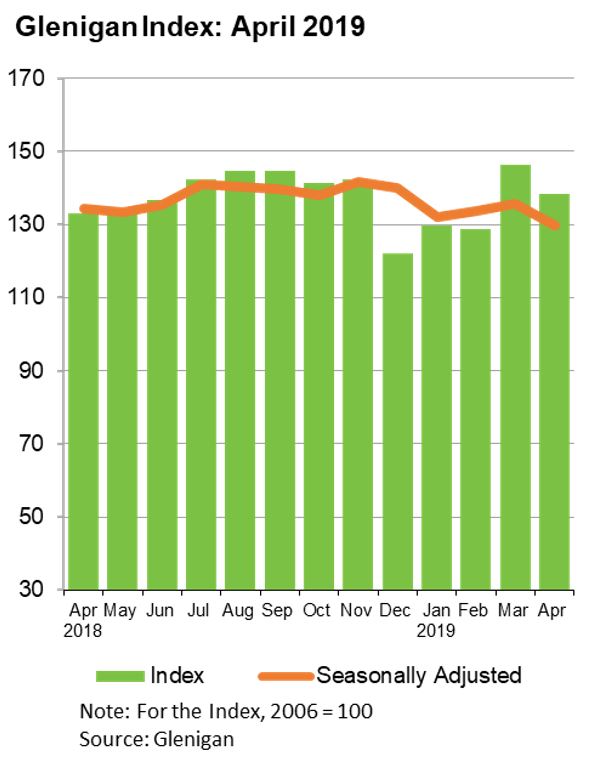

- Starts in the three months to April rose 7% against the preceding three months and were 4% higher than a year ago

- Residential starts were 4% lower than a year ago and unchanged on the preceding three months

- Non-residential project starts were 3% higher than a year ago, lifted by a rise in commercial work

- Civil engineering starts rose 18% against the preceding three months and were 50% higher than a year ago

The value of work starting on site during the three months to April was 4% higher than a year earlier, according to the latest Glenigan Index. Starts were also 7% higher against the previous three months on a seasonally adjusted basis.

Commenting on this month’s figures, Allan Wilén, Glenigan’s Economics Director, said “An improved April performance has provided a spring time lift, with the residential, non-residential and civil engineering sectors all seeing a rise in projects starts. Private sector and infrastructure projects provided the upturn in project starts, while government funded areas such as health, education and social housing remained weak.

“Private residential starts steadied during the three months to April. Project starts had been weakening since last autumn against a backdrop of fewer property transactions and weaker house price inflation in the wider housing market. However private housing starts rose 3% during the three months to April against the preceding three months on a seasonally adjusted basis, although starts were 7% down on a year ago. Social housing starts fell 6% against the three months to January, but were 4% up on a year ago.

“Overall non-residential projects rose 3% against the preceding three months on a seasonally adjusted basis and were 11% higher than a year ago. Private sector starts picked up from their recent weak performance with office, retail and hotel & leisure work rising during the three months to April rising by 13%, 39% and 32% respectively against a year ago. In contrast government funded sectors remain weak, with education starts 20% down on a year ago, and health and community & amenity sectors dropping by 6% and 41% respectively.

“Civil engineering starts rose 18% against the three months to January on a seasonally adjusted basis and were 50% higher than on a year ago. The rise in project starts was driven by a 35% rise (seasonally adjusted) in infrastructure work against the previous three months, while utilities projects rose 4% during the same period.

There was a sharp variation in the industry’s performance across the UK. Regionally the sharpest falls were in the East of England and Scotland with declines of 18% and 22% respectively. Starts in the North East, North West, West Midlands and South West also declined. In contrast, the value of starts in London, Wales and Northern Ireland were 85%, 50% and 97% higher than a year ago, while the East of Midlands, South East and Yorkshire & the Humber all saw double digit growth.