Nothing less than the future of the concrete industry – and the world’s climate – is at stake in a research project trying to devise ways to make low-carbon concrete viable.

Ten trillion cubic metres of concrete are made every year. This means that a lot of climate-warming carbon dioxide is emitted into the atmosphere using standard cement, which equates to 8 per cent of the world’s total CO2 emissions.

To accommodate a growing population and its associated demands, the global construction industry plans to add 2.48 trillion square feet (230 billion m2) of new floor area to the global building stock, effectively doubling global building stock by as early as 2060. This is the equivalent of adding an area the size of Paris to the planet’s building stock, every week. New building stock must be designed to meet net-zero-carbon standards, as explained by Lara Shear from The Planet Mark.

So why doesn’t the construction industry simply shift to low-carbon concrete? It’s been around for years and could reduce concrete-related carbon dioxide emissions by a fantastic 50 per cent. One of the most straightforward ways to reduce emissions from concrete production is to produce cement with blast furnace ash or fly ash. Unfortunately, it’s not quite the like-for-like swap it sounds.

“It is important to convince the concrete industry that investing in low carbon is worthwhile. We aim to ensure that the results of the project can be widely used by companies in concrete production and construction. Only in this way can climate emissions be reduced.”

– Dr Jouni Punkki

Professor of Practice in Concrete Technology, Department of Civil Engineering, Aalto University

Slower Strength Development

“Low-carbon concrete is by no means a new phenomenon,” agrees Dr Jouni Punkki, Professor of Practice in Concrete Technology at the Department of Civil Engineering at Aalto University in Espoo, Finland. “Using cement made using blast furnace ash or fly ash is the most effective way to reduce emissions from concrete production.”

However, according to Punkki, concrete using blast furnace ash cement is not more popular because of its slower strength development, compared to standard concrete. In the precast industry, for example, low-carbon concrete can take up to 18 hours after casting to be ready – much longer than normal. “Low-carbon blast furnace concrete has a slower strength development compared with the concretes made of conventional cements,” says Dr. Punkki. “This significantly extends the production cycle and reduces the profitability of concrete element production.”

The LOIKKA Project

Punkki is leading Aalto University’s contribution to the LOIKKA project. LOIKKA is a joint venture consisting of the Confederation of Finnish Concrete Industries, Confederation of Finnish Construction Industries, Finnish Transport Infrastructure Agency, Aalto University, and five companies, including precast concrete technology expert Elematic. The project began in March 2022 and is due to run for two years. LOIKKA’s ambitious objective is to reduce carbon dioxide emissions from concrete construction in Finland by 50 per cent.

The project is investigating how to overcome the initial strength challenges of concrete and make blast furnace ash concrete more feasible in use. A major area of research in concrete technology at Aalto University’s Department of Civil Engineering is the use of digitalisation and automated measurement methods in concrete production.

“It is important to convince the concrete industry that investing in low carbon is worthwhile. We aim to ensure that the results of the project can be widely used by companies in concrete production and construction. Only in this way can climate emissions be reduced,” believes Dr. Punkki.

Waste-saving Precast Techniques

One of the companies supporting the project is Finnish precast concrete technology expert Elematic. “Elematic’s customers have hundreds of factories around the world,” says Jani Eilola, Director of Floor and Acotec Technologies at Elematic. “If we can help them make the transition to low-carbon concrete, it will have a big impact on the climate.”

The transition to low-carbon concretes poses a particular productivity challenge for precast concrete plants: how to maintain productivity when low-carbon concretes dry more slowly than conventional concretes.

One of the objectives of the project is to assess the carbon footprint of floor and wall precast concrete. As part of this Elematic will carry out test castings of low-carbon precast concrete elements. Based on the research, the company will determine what changes are needed to the production lines to make low carbon concrete a viable replacement for normal concrete in precast applications.

“With LOIKKA, we want to develop production technology in a way that maintains the current mould cycle,” says Elematic’s Eilola. “To speed up the introduction of low-carbon precast concrete elements for our customers, we are looking into alternate formulations of low-carbon concretes. Heat treatment of the concrete mix can also speed up drying and strength formation. The know-how we gain from this project can be shared with our customers around the world.”

Carbon Neutrality by 2025

Despite its current limitations Professor Punkki, who will join an Elematic panel discussions on the subject at Bauma, estimates that low-carbon cement production volumes will overtake conventional cement globally after the end of this decade, and carbon neutrality in concrete production could be achieved as early as 2035.

In terms of climate change mitigation, as well as competitiveness, there is much to be gained from a shift to low-carbon concrete. As a result of a more assertive climate policy, EU emission allowances are becoming more expensive and free allowances phased out. These costs will be passed from concrete production back up the value chain. Ultimately, building owners and users will pay the price. Therefore, if low-carbon options can be made viable, using low-carbon concrete will increasingly give companies a competitive edge.

Alternative & Additional Progress

Thanks to unique research from Chalmers University of Technology, Sweden, entire twenty-storey concrete buildings which can store energy like giant batteries could someday be a commonplace city reality. Researchers from the Department of Architecture and Civil Engineering recently published an article outlining a new concept for rechargeable batteries made of cement.

The concept involves first a cement-based mixture, with small amounts of short carbon fibres added to increase the conductivity and flexural toughness. Then, embedded within the mixture is a metal-coated carbon fibre mesh – iron for the anode, and nickel for the cathode. After much experimentation, this is the prototype which the researchers now present.

ThisWeekinFM attended Design London for 2022 to cover new and interesting innovations in the world of property design and spoke to Ben Harries from Versarien about the company’s 3D-printed mortar. Using a cement-free, mould-free process they can build bespoke architecture, including building foundations. Especially in comparison to precast, the method is particularly cost-effective for projects with a variety of forms needed, and this technology is becoming cheaper to utilise for wider applications also, making it very valid for future net-zero construction.

Source: TwinFM

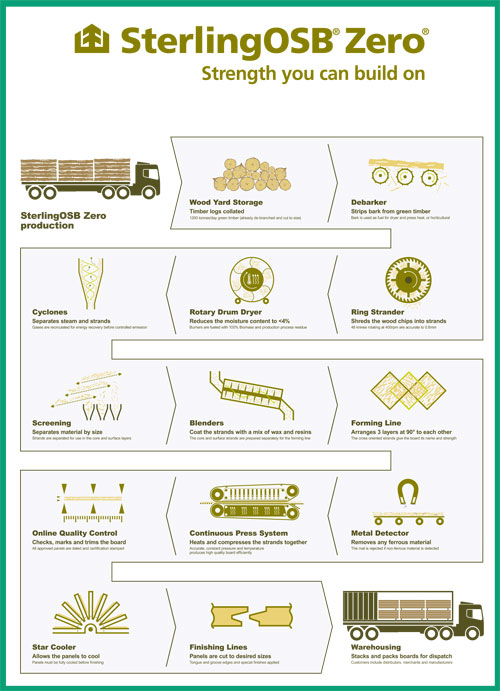

How SterlingOSB Zero is manufactured is, in itself, a complex and fascinating process: beginning with the trees being harvested from UK or European forests, which are de-branched/cut to size and delivered as green timber to the wood storage area of the factory.

How SterlingOSB Zero is manufactured is, in itself, a complex and fascinating process: beginning with the trees being harvested from UK or European forests, which are de-branched/cut to size and delivered as green timber to the wood storage area of the factory.