Chris Goggin explains what E-methane is, how it is produced and its potential relevance inside the UK alternative gasses market. An informed synopsis of the current off grid gas and energy market will be used to highlight how E-methane and other lesser well-known gasses such as Bio-LPG and biomethane can contribute towards off-grid NetZero aims and support commercial enterprises.

To attain NetZero status future usage of fossil fuels will need to be limited in the medium term and eventually nullified, completely. A range of alternative energies that include renewables, hydrogen and clean electrification will replace fossil fuels. E-Methane is a new gas that has been identified as an additional low carbon gaseous alternative capable of performing the same role as fossil fuels.

E-methane is the abbreviated name given to electro-methane, a gas which is created by extracting captured carbon dioxide and blending with green hydrogen, itself produced via renewable energy.

The number of e-methane production plants across Europe and Australia is notably increasing. Danish energy supplier, Andel, and Danish biogas company, Nature Energy, have invested DKK 100 million in constructing and operating an e-methane plant located in Glansager, Denmark.

Australia is the chosen location of three Japanese energy concerns who are exploring e-methane production possibilities. Tokyo Gas, Toho Gas, Osaka Gas Australia (OGA) alongside Australian oil and gas company Santos have entered into an agreement that will focus on producing 130,000 tonnes of e-methane annually. E-methane is 1 of 14 priorities that the Japanese government’s Green Growth Strategy has highlighted as a major component towards Japanese decarbonisation objectives.

Finnish energy company Nordic Ren-Gas Oy is developing a Power-to-Gas project located in Tampere, Finland. The production facility will manufacture hydrogen and e-methane as well as provide power for local district heating sourced through waste heat. Nordic Ren-Gas Oy are actively seeking to introduce a decentralised e-methane production network throughout Finland that assists in reducing fossil fuel usage.

E-methane is remarkably like biomethane which is produced in a separate process – methane is captured from natural biological waste and forms during a natural process called ‘anaerobic digestion.’ In the absence of oxygen microorganisms will begin to break down matter yielding a gas – methane. Once impurities are removed the methane gas becomes upgraded and biomethane is created.

Both biomethane and e-methane are capable of identical operating behaviour when compared to fossil fuels and can therefore be placed into existing infrastructure. Biomethane and e-methane can immediately fulfil the role of fossil fuels without any fracture towards appliance operating efficiency, commercial activity, or societal cohesion.

E-methane and biomethane are potential fuels that can be used in off-grid applications also. The UK off-grid fuel market is a growing economic entity and is also a hard-to-decarbonise section of society. The UK’s gas grid network extends to 84% of UK households. Of the remaining 16%, 2 million properties are rural off grid homes and require daily power.

The primary power source used to fuel off grid UK properties and commercial activities is LPG and there is growing usage of BioLPG. The tourism and leisure sector also relies on off grid fuels and utilises both LPG and BioLPG as its main source of power. There are 2,643 businesses in the Caravan & Camping Sites industry in the United Kingdom, which has grown at a CAGR (Compound Annual Growth Rate) of 3.6 % between 2020 and 2025.

LPG is created through the refining of crude oil or extracted during the process of manufacturing natural gas. LPG consists of butane and propane and is considered a low carbon alternative to fossil fuels.

BioLPG contains an almost identical chemical structure to LPG. BioLPG is produced from renewable materials derived from a diverse mix of sustainable biological feedstocks and processes. Supported through cleaner sourced chemical ingredients BioLPG provides huge benefits in carbon reductions and air quality, compared to traditional off-grid fuels such as heating oil.

BioLPG is conceptually renewable and sustainable, as it is made from a blend of waste, residues, and sustainably sourced materials. BioLPG, can be described as an eco-propane, the chemical makeup of this gas is identical to LPG and is therefore compatible with existing in situ LPG products from a combustion perspective.

The market for synthetic and biogas in Europe is expanding, UK liquefied petroleum gas market is projected to lead the regional market in terms of revenue in 2030. In the UK, around 10% of off-grid properties use LPG for heating, which translates to approximately 220,000 users. In terms of revenue, UK accounted for 4.3% of the global liquefied petroleum gas market in 2023.

Off grid fuels, synthetic gasses and biogas are areas in which growth is expected to rise steadily through the up-and-coming decade. E-methane is considered a convenient alternative capable of being placed in existing infrastructure and successfully fulfilling the role of natural gas. European and the Asia-Pacific regions are refining strategies that centre on the production and distribution of e-methane and are confident that commercial sales will follow.

Biogas and synthetic gasses such as BioLPG, LPG, e-methane and Biomethane will play a discernible role in the global pursuit of NetZero. Current UK and European off grid gas markets maintain an upward trajectory.

Potential usage of alternative gasses can only increase as NetZero time limits recede, meaning that any gas capable of operational capabilities and behavioural similarities to natural gas will instantly be viewed favourably due to current infrastructure and natural gas reliance.

As the continued pursuit of low carbon and zero carbon energy and power sources continues both BioLPG and e-methane are promising variants on the road to net zero.

CLICK HERE

to learn more about renewable fuels and technologies follow our free newsletter

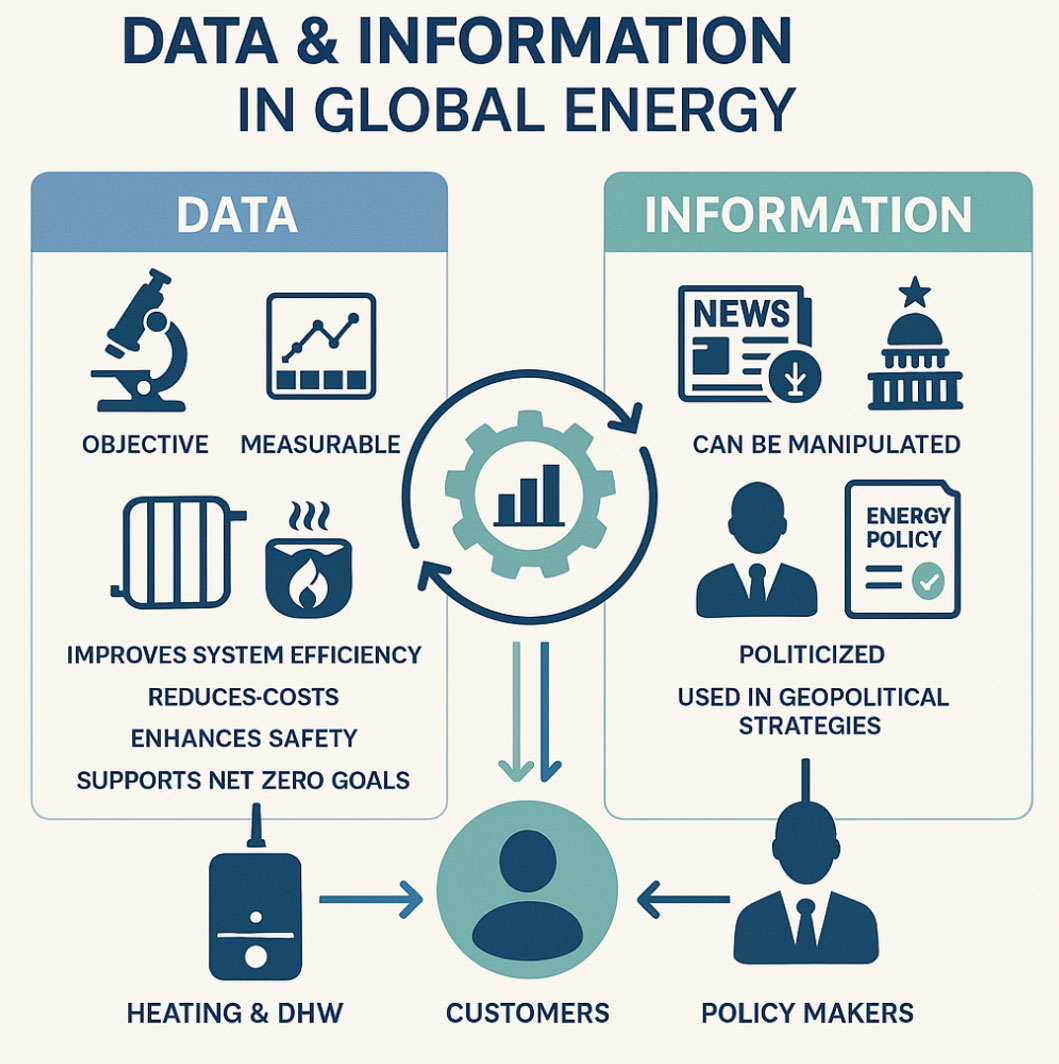

Rinnai follows all domestic and international developments in current and future energy information. Doing so, provides potential customers with a solid foundation of information that assists product purchase. Any news relating to appliance or energy options that is shaped by legislation will be immediately shared with UK customers. Access to information that affects customer judgment is an area that is Rinnai values.

RINNAI’S H3 DECARBONISATION OFFERS PATHWAYS & CUSTOMER COST REDUCTIONS

FOR COMMERCIAL, DOMESTIC AND OFF-GRID HEATING & HOT WATER DELIVERY

www.rinnai-uk.co.uk/about us/H3

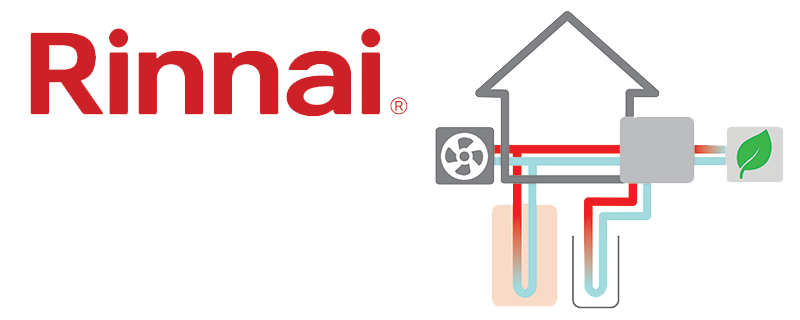

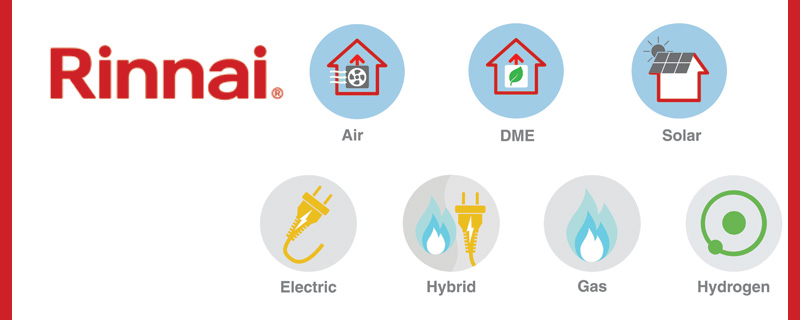

Rinnai’s H3 range of decarbonising products include hydrogen / BioLPG ready technology, hybrid systems, and a wide range of LOW GWP heat pumps and solar thermal. Also, within Rinnai’s H3 range is Infinity hydrogen blend ready and BioLPG ready continuous flow water heaters which are stacked with a multitude of features that ensure long life, robust & durable use, customer satisfaction and product efficiency.

Rinnai’s range of decarbonising products – H1/H2/H3 – consists of heat pump, solar, hydrogen in any configuration, hybrid formats for either residential or commercial applications. Rinnai’s H3 range of products offer contractors, consultants and end users a range of efficient, robust and affordable decarbonising appliances which create practical, economic and technically feasible solutions. The range covers all forms of fuels and appliances currently available – electric, gas, hydrogen, BioLPG, DME solar thermal, low GWP heat pumps and electric water heaters.

Rinnai H1 continuous water heaters and boilers offer practical and economic decarbonization delivered through technological innovation in hydrogen and renewable liquid gas ready technology.

Rinnai’s H1 option is centred on hydrogen, as it is anticipated that clean hydrogen fuels will become internationally energy market-relevant in the future; Rinnai water heaters are hydrogen 20% blends ready and include the world’s first 100% hydrogen-ready hot water heating technology.

Rinnai H2 – Decarbonization simplified with renewable gas-ready units, Solar Thermal and Heat Pump Hybrids. Rinnai H2 is designed to introduce a practical and low-cost option which may suit specific sites and enable multiple decarbonisation pathways with the addition of high performance.

Rinnai H3 – Low-GWP heat pump technology made easy – Rinnai heat pumps are available for domestic and commercial usage with an extensive range of 4 – 115kW appliances.

Rinnai’s H3 heat pumps utilise R32 refrigerant and have favourable COP and SCOP.

Rinnai is a world leading manufacturer of hot water heaters and produces over two million units a year, operating on each of the five continents. The brand has gained an established reputation for producing products that offer high performance, cost efficiency and extended working lives.

Rinnai’s commercial and domestic continuous flow water heaters offer a limitless supply of instantaneous temperature controlled hot water and all units are designed to align with present and future energy sources. Rinnai condensing water heaters accept either existing fuel or hydrogen gas blends. Rinnai units are also suited for off-grid customers who require LPG and BioLPG or DME.

Rinnai products are UKCA certified, A-rated water efficiency, accessed through multiple fuel options and are available for purchase 24/7, 365 days a year. Any unit can be delivered to any UK site within 24 hours. Rinnai offer carbon and cost comparison services that will calculate financial and carbon savings made when investing in a Rinnai system. Rinnai also provide a system design service that will suggest an appropriate system for the property in question. Rinnai offer comprehensive training courses and technical support in all aspects of the water heating industry including detailed CPD’s.

CLICK HERE TO VISIT THE RINNAI WEBSITE

or HERE to EMAIL RINNAI

CLICK HERE For more information on the RINNAI product range