RATE OF DECLINE IN CONSTRUCTION SLOWS AGAIN IN DECEMBER

KEY FINDINGS

Slowest decline in total activity for four months

Renewed rise in employment numbers

Suppliers’ delivery times improve again

December data indicated another solid fall in UK construction activity, although the rate of decline eased to the slowest since the current phase of decline began last September. A sustained slump in house building was the main factor holding back construction output, which survey respondents linked to elevated interest rates and subdued confidence among clients.

Improving supply conditions continued in December, with delivery times for construction items shortening for the tenth month in a row. Price discounting among suppliers contributed to a moderate fall in average cost burdens across the construction sector at the end of 2023.

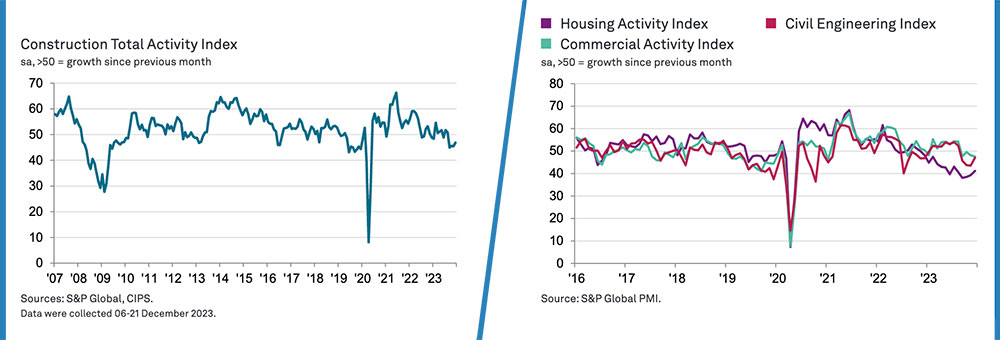

At 46.8 in December,the headline S&PGlobal UK Construction Purchasing Managers’ Index™ (PMI®) – a seasonally adjusted index tracking changes in total industry activity – was below the neutral 50.0 mark for the fourth month running. However, the index was up from 45.5 in November and the highest for four months.

House building remained the weakest-performing category of construction work in December (index at 41.1), despite the rate of decline easing to its slowest since July 2023. Civil engineering activity (index at 47.0) also posted a softer pace of contraction at the end of last year.

Commercial construction meanwhile declined only modestly (index at 47.6), but the speed of the downturn accelerated to its fastest since January 2021. Some firms noted that concerns about the domestic economic outlook, alongside elevated borrowing costs, had led to greater caution among clients.

Total new work decreased at the slowest pace since the current period of decline began in August 2023. Subdued customer demand across the house building sector was often cited as a factor leading to reduced order books.

A softer decline in new work and hopes of a turnaround in demand conditions during 2024 contributed to a renewed rise in employment numbers in December. However, the rate of job creation was only marginal.

Mirroring the trend for construction output, latest data indicated the slowest fall in purchasing activity for four months. Where a decline in input buying was reported, this often reflected a lack of new work to replace completed projects.

Lower demand for construction products and materials resulted in shorter wait times for suppliers’ deliveries in December. Improving vendor performance has been recorded in each month since March 2023. Survey respondents often noted that competition for market share among suppliers had led to price discounting at the end of last year. Average cost burdens across the construction sector decreased for the third month running in December, albeit only modestly and at the slowest pace during this period.

Finally, latest data indicated somewhat upbeat business expectations at UK construction companies for output levels during the year ahead. Around 41% of the survey panel anticipate an increase in business activity over the course of 2024, while only 17% predict a decline. Anecdotal evidence suggested that subdued forecasts for the UK economy were a key concern, while hopes of reduced interest rates and a turnaround in market confidence were factors cited as likely to boost construction activity.

Fraser Johns, finance director at Beard, said:

“In what has become a consistent theme for the industry, weak performance in the house building sector continues to hold back construction output and weigh heavily on overall new work.

“A key driver has been elevated borrowing costs and general uncertainty in the economy, which is also being felt in the commercial space – contributing to a modest decline in the sector. It may be the case that clients don’t quite have the confidence just yet to commit to large-scale construction projects. Saying that, our view on the ground in the south remains positive with high demand – particularly from frameworks, and growing interest on the south coast as we prepare to open our latest regional office.

“There’s no question that resilience is key at the moment and the ability for firms to hold their nerve. While 2024 will undoubtedly present its fair share of challenges, we are beginning to see some positive indicators for the year ahead and expectations of falling interest rates. However, this does depend on the appetite of the Bank of England and the economy avoiding any substantial shocks. There’s an element of controlling what we can control right now and nurturing those close relationships with clients as confidence begins to return.”

Brian Berry, Chief Executive of the FMB commented:

“December’s Construction Output data once again shows a continued decline in house building rates, with commercial construction rates also down. There are, however, positive signs that the rate at which activity within the industry is declining is starting to slow, giving hope that 2024 may be a year when we finally start to see improvement. If the Government is serious about substantially boosting the UK’s house building rates and the wider construction industry, it must look at this as an opportunity to make real progress.”

Leave a Reply

Want to join the discussion?Feel free to contribute!