A bridge over the River Wye in Builth Wells. Picture by Mick Pleszkan.

One of Powys’ leading architects has warned that hundreds of new affordable and social homes in the county are at risk due to planning applications coming to a virtual standstill.

Hughes Architects claim measures to reduce high phosphate levels in some of the area’s rivers, including the River Wye, are seriously impacting on the planning system, particularly in south Powys and Ceredigion.

Planning applications for everything from small house extensions to large-scale housing scheme are now affected.

Doug Hughes, managing director and principal architect at Hughes Architects, which has Powys offices in Newtown and Welshpool and operates throughout Wales and the border areas, has warned the consequences of not finding a solution to the problem soon will impact on the ability of local authorities and housing associations to deliver new social housing projects, in addition to affordable and private developments. “It’s the perfect storm. We have high levels of demand for social, affordable and private housing in areas such as Powys and Ceredigion and yet we are at a virtual standstill in the ability to deliver planning approvals due to the current restrictions on all forms of development,” said Mr Hughes.

“It’s also impacting on private individuals who want to extend or convert properties. We fear the whole planning system is on the cusp of coming to a standstill.”

According to reports, phosphate levels in the Wye catchment area are four times higher in soils surrounding it, threatening its health and the wider ecosystem.

The River Wye has turned green at certain points of the year in recent years because of algal blooms

The intense rise in chicken farms in Powys in the last decade is seen by many as a major contributing factor to increased phosphate levels in the Wye – although the agricultural industry disputes this, with bodies like the National Farmers Union speaking out often.

In December 2020, however, Natural Resources Wales (NRW) said poultry units were just one of many reasons that could be contributing to failing phosphate levels. In January 2021 the agency said the Wye had failed to reach phosphate testing standards.

NA Judicial Review, meanwhile, into whether the action plan on phosphates in the Wye by NRW and their English counterparts was unlawful, was launched by nature campaign group Wild Justice last November. And earlier this year, the Environmental Audit Committee’s Water Quality in Rivers report – headed by influential MPs – supplied evidence saying NRW and its counterparts had failed to provide a solution to the problem. RW introduced new planning advice in January this year for Special Areas of Conservation impacting rivers. It requires proof that any development, regardless of size, would not contribute to increased levels of phosphates in waterways.

The Welsh Government has said while housing of all types is a priority, resilience of river ecosystems cannot be compromised. The government plans to support the development of 20,000 new affordable homes in Wales over the next three years, but this advice means this is practically unachievable.

“We recognise the causes of phosphate pollution in our rivers are complex and no single measure will solve the issue,” added Mr Hughes.

“We also recognise that our own developments and planning applications cannot compromise the health of our rich natural resources, which is why our team at Hughes Architects works so hard with planning departments and consultees to ensure this does not happen. All the same, advice from NRW and government needs to be clear and proportionate.

“In the case of most domestic developments, it is highly likely there would be no impact in terms of phosphate generation. But the additional planning advice impacts on everything from a simple house extension to a large housing scheme.

“We know discussions are ongoing between a range of stakeholders involved, but these need to be accelerated or we face a serious housing and property crisis. Delays now will impact on the ability to begin work on much needed homes in the coming years.”

Mr Hughes said his firm has adapted to become multi-disciplinary in recent years in response to the increasing complexity of the planning system.

He added: “We now employ a team of in- house specialist drainage engineers who have the experience and expertise to come up with solutions to tackle this issue.

“But this all takes time and as each planning application is judged on its own merits, then this invariably leads to delay in securing approvals.

“We need urgent clear and decisive advice from NRW and the Welsh Government to develop solutions to this complex issue.”

A spokesperson for Powys County Council said: “All planning applications that would generate additional phosphate within a river Special Area of Conservation catchment in the Powys Local Planning Authority area are determined on their own merits in accordance with legislative/regulatory requirements and have regard to Natural Resources Wales’s latest planning advice.

“This approach is consistent with that taken by all other authorities across Wales with river Special Area of Conservation catchments, and a similar approach has been taken in England by Natural England.

“This has resulted in some planning applications being refused planning permission in order to protect a river Special Area of Conservation and its conservation objectives.

“Planning permission can only be lawfully granted where it can be determined with certainty that the proposed development would not have a likely significant effect on a river Special Area of Conservation.”

The latest planning advice from NRW was last updated in May 2021 and is available on their website.

Source: Country Times

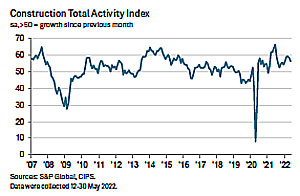

May PMI® data signalled another growth slowdown in the construction sector amid a considerable loss of momentum for the residential category. The latest rise in housing activity was the weakest since the recovery began two years ago. Survey respondents suggested the subdued consumer confidence and worries about the economic outlook had constrained demand.

May PMI® data signalled another growth slowdown in the construction sector amid a considerable loss of momentum for the residential category. The latest rise in housing activity was the weakest since the recovery began two years ago. Survey respondents suggested the subdued consumer confidence and worries about the economic outlook had constrained demand.