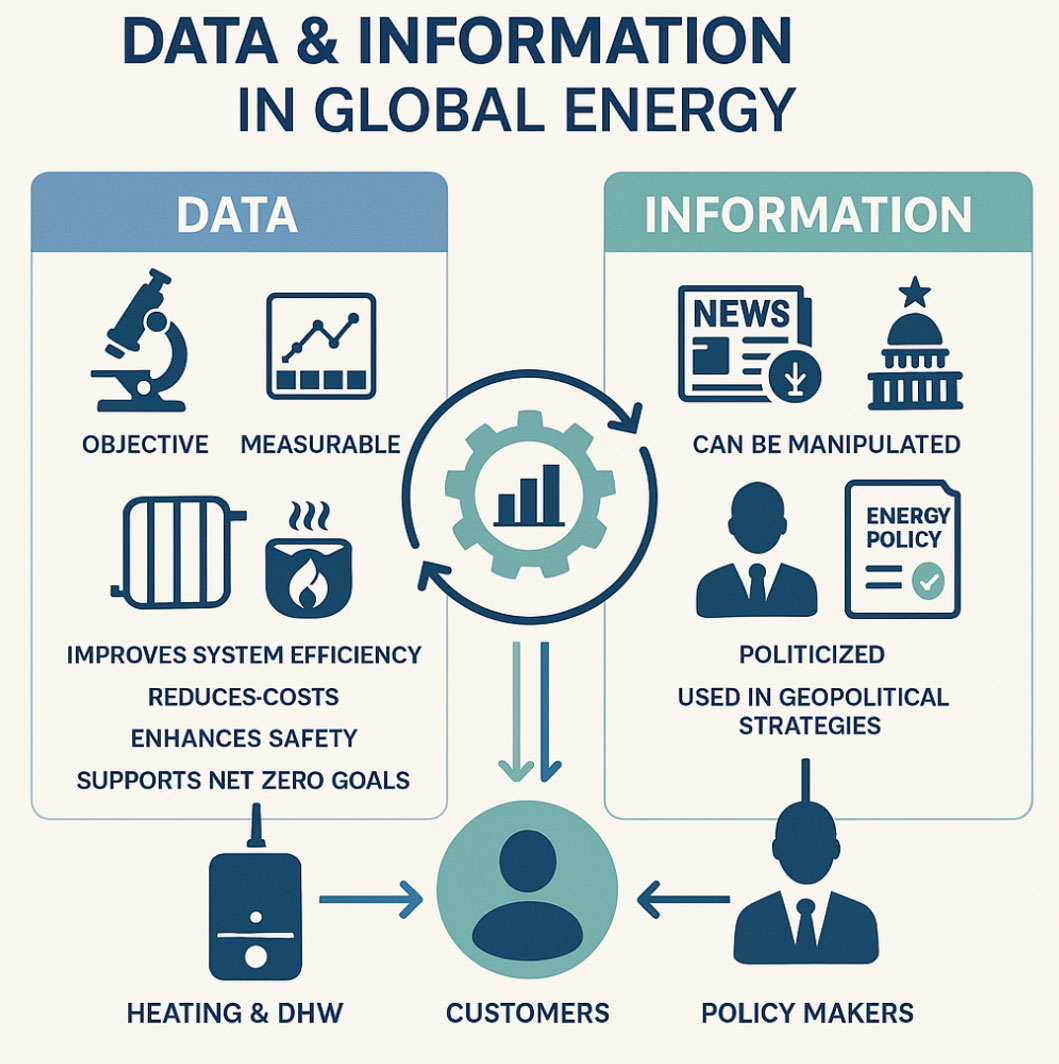

Chris Goggin analyses the role and key distinctions between data and information in the current UK and international energy market. The influence of data driven DHW and heating system improvements will be explored, as will the subject of misinformation that is spread across mainstream and alternative media platforms.

Heating appliance and hot water delivery manufacturers are reliant on two abstract inflections of the same tool of communication – data and information. Both are vital to the UK heating and hot water delivery industry. Without consistent flows of data and information, appliance performance stalls, and UK customers become less aware of cost-effective energies and products.

The first distinction this article will make is the difference between data and information. Data can be used to record performance and judge measurements. Without reliable data and scientifically ratified metrics manufacturing precise technology that provides commercial premises with heating and hot water appliances becomes an impossible task.

Recorded data enables system design upgrading for heating and DHW appliances. Primarily collected data assists system refinement which leads to increases in system efficiency and product life cycle, both of which mean lower customer costs.

Collected data also helps to bring forward better designed systems that do not require as much maintenance as previously designed models. Again, customer costs will be positively affected.

Information regarding energy and appliances can be thought of in two distinct ways: the first way views information in a one-dimensional context. Information is a route for customers to learn about various products, their benefits and what energies best suit said appliance.

Energy policy information is far more malleable in practise. Legislative information can be restructured into a form that compliments a political agenda and subsequently released across multiple friendly media outlets.

This is the main difference between data and information – data is a result of a logical sequence of scientific methodology that provides confirmed results. Data is vital towards upgrading system performance and component optimisation. Without data, system designers, contractors, specifiers, and customers all lose control of project objectives.

Data ensures areas such as hot water consumption can precisely highlight peak usage times and patterns. Correct system sizing will dictate energy consumption and efficiency whilst preventing over and under sizing a DHW system.

Other areas that data collection for DHW systems enhance include seasonal variations, building type and size, component optimisation and energy efficiency. All elements of data recording and reading create a foundation from which improvements and observations can be made meaning the appropriate system can be selected for a specific property.

Information concerning energy is presented and received by a mass audience in a unique way when compared to data. Energy is a focal point in geopolitics and is therefore prone to being used as a tool of ambition by large economies and sometimes as a weapon. The 1973 Iranian oil embargo being one example.

As energy can be weaponised in a state context, media outlets that are sympathetic to energies that benefit the favoured political movement. This is demonstrated across the western world in one simple distinction: proponents of right-wing political ideals prefer fossil fuels, whilst those on the left favour clean alternatives such as renewables.

Placement of Information on energy policy in selected media can therefore be viewed as partisan and strategic. Where the use of data is concerned with producing tighter operational capabilities, energy policy information is usually aimed towards maintaining or diminishing political support.

Information relating to energy usage has never been so politicised or weaponised. Putin instigated a spike in fossil fuel payments when the invasion of Ukraine began and now Trump’s “drill baby drill,” comment has been almost adopted into American Conservative identity.

Trump’s verbal slogan arrives at a time where public confidence in alternative and renewable energy appears to be declining. Renewable energy has been blamed for the recent blackouts in France, Spain, and Portugal. It is claimed that renewable solar and wind energy fails to connect to the transmission grid in the same way as fossil fuels. There has not been a confirmed cause of this event released by the respective governments.

Consistent UK media and political opposition to renewables that insists that NetZero aims should be reduced due to costs is based on partisan beliefs – not science. Any political organisation that is reliant on attracting votes through energy policy that promises low costs and uninhabited access to energy will be used despite contradictory scientific advice and information.

Gathered data has outlined that global temperatures are rising and are a result of manufactured activities. Rising temperatures create fertile conditions for drought, cyclones, and rising water levels. All events are potentially catastrophic for life on planet Earth. This knowledge has been attained via various disciplines of data recording. NetZero objectives are resultant from scientific observations.

Designers, specifiers, contractors, and installers should consider using manufacturers of heating and hot water systems that aim to provide unbiased energy policy information and reliable data that demonstrate product benefits in costs and performance.

RINNAI’S H3 DECARBONISATION OFFERS PATHWAYS & CUSTOMER COST REDUCTIONS

FOR COMMERCIAL, DOMESTIC AND OFF-GRID HEATING & HOT WATER DELIVERY

Rinnai’s H3 range of decarbonising products include hydrogen / BioLPG ready technology, hybrid systems, and a wide range of LOW GWP heat pumps and solar thermal. Also, within Rinnai’s H3 range is Infinity hydrogen blend ready and BioLPG ready continuous flow water heaters which are stacked with a multitude of features that ensure long life, robust & durable use, customer satisfaction and product efficiency.

Rinnai’s range of decarbonising products – H1/H2/H3 – consists of heat pump, solar, hydrogen in any configuration, hybrid formats for either residential or commercial applications. Rinnai’s H3 range of products offer contractors, consultants and end users a range of efficient, robust and affordable decarbonising appliances which create practical, economic and technically feasible solutions. The range covers all forms of fuels and appliances currently available – electric, gas, hydrogen, BioLPG, DME solar thermal, low GWP heat pumps and electric water heaters.

Rinnai H1 continuous water heaters and boilers offer practical and economic decarbonization delivered through technological innovation in hydrogen and renewable liquid gas ready technology.

Rinnai’s H1 option is centred on hydrogen, as it is anticipated that clean hydrogen fuels will become internationally energy market-relevant in the future; Rinnai water heaters are hydrogen 20% blends ready and include the world’s first 100% hydrogen-ready hot water heating technology.

Rinnai H2 – Decarbonization simplified with renewable gas-ready units, Solar Thermal and Heat Pump Hybrids. Rinnai H2 is designed to introduce a practical and low-cost option which may suit specific sites and enable multiple decarbonisation pathways with the addition of high performance.

Rinnai H3 – Low-GWP heat pump technology made easy – Rinnai heat pumps are available for domestic and commercial usage with an extensive range of 4 – 115kW appliances.

Rinnai’s H3 heat pumps utilise R32 refrigerant and have favourable COP and SCOP.

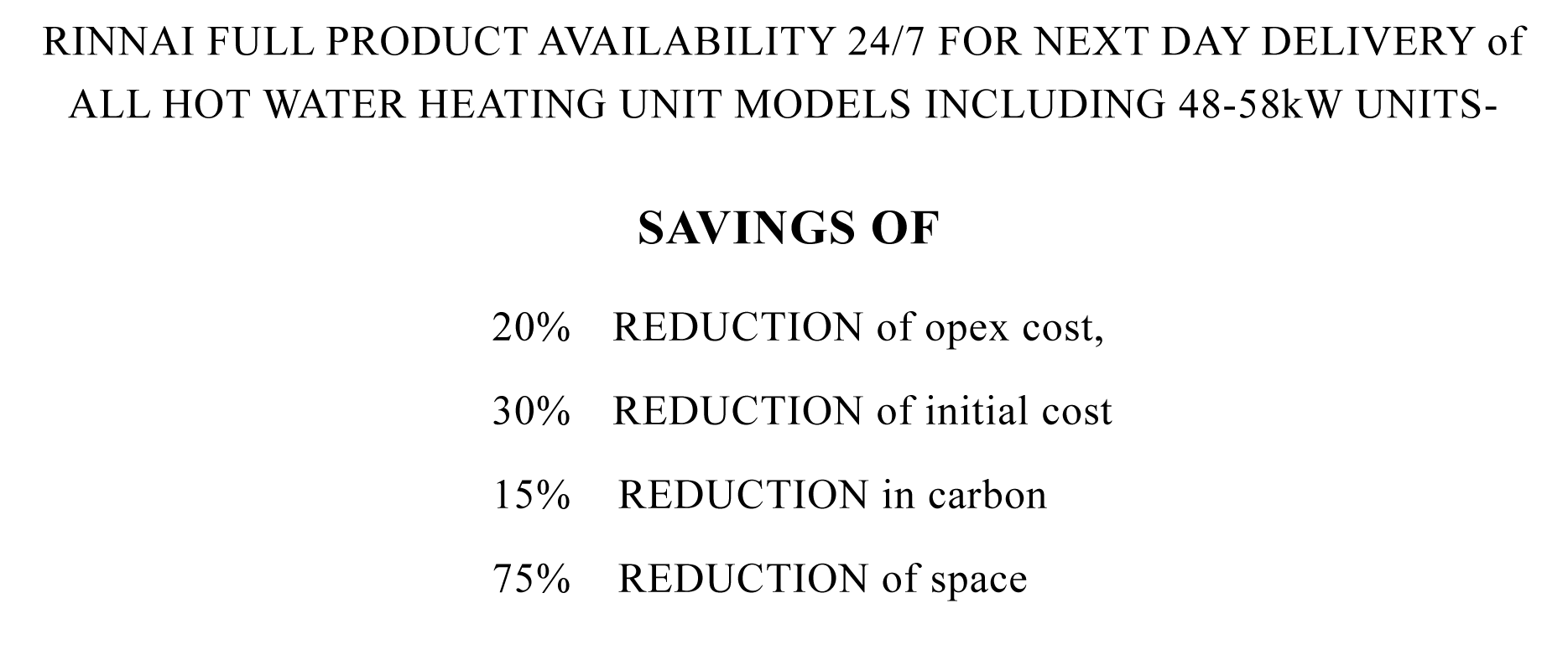

Rinnai is a world leading manufacturer of hot water heaters and produces over two million units a year, operating on each of the five continents. The brand has gained an established reputation for producing products that offer high performance, cost efficiency and extended working lives.

Rinnai’s commercial and domestic continuous flow water heaters offer a limitless supply of instantaneous temperature controlled hot water and all units are designed to align with present and future energy sources. Rinnai condensing water heaters accept either existing fuel or hydrogen gas blends. Rinnai units are also suited for off-grid customers who require LPG and BioLPG or DME.

Rinnai products are UKCA certified, A-rated water efficiency, accessed through multiple fuel options and are available for purchase 24/7, 365 days a year. Any unit can be delivered to any UK site within 24 hours. Rinnai offer carbon and cost comparison services that will calculate financial and carbon savings made when investing in a Rinnai system. Rinnai also provide a system design service that will suggest an appropriate system for the property in question. Rinnai offer comprehensive training courses and technical support in all aspects of the water heating industry including detailed CPD’s.