Spring Surge for Housing

Construction sees spring surge as housing powers ahead

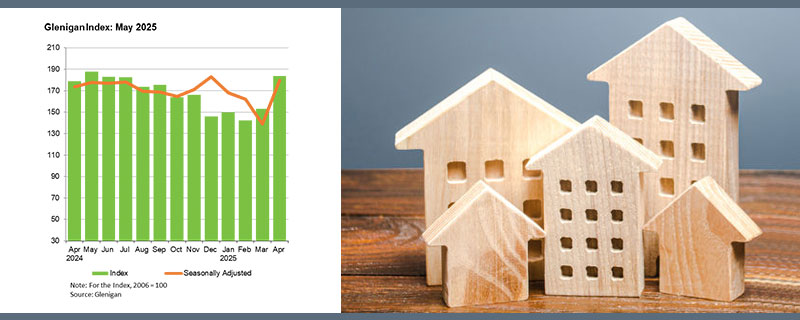

Glenigan, the construction industry’s leading insight experts, has released the May 2025 edition of its Construction Index.

The Index focuses on the three months to the end of April 2025, covering all underlying projects, with a total value of £100m or less (unless otherwise indicated), with all figures seasonally adjusted.

It’s a report which provides a detailed and comprehensive analysis of year-on-year construction data, giving built environment professionals a unique insight into sector performance over the last 12 months.

Construction starts saw a welcome lift in the three months to April. Overall, the value of underlying work starting on-site rose 7% on the previous quarter and remained 3% ahead of last year’s levels, a sign of resilience despite challenges elsewhere.

Housebuilding was the clear bright spot, helping to prop up wider industry performance. Private and social housing drove a 24% quarterly rise in project-starts. Private housing alone surged 29% year-on-year, while social housing experienced a 3% upturn annually after a strong spring showing.

Performance in non-residential verticals was mixed. While some sectors, including community & amenity, health and offices, saw strong gains, others, including education, hotel & leisure and retail, posted sharp declines. Meanwhile, civils suffered a significant setback. Starts fell 22% quarterly and annually, reflecting a slowdown across infrastructure and utilities projects.

Providing further insight on these results, Allan Wilen, Glenigan’s Economics Director, says,

“Builders were reporting falling workloads at the end of last year, reflecting a period of real uncertainty across the construction sector. However, the latest figures, particularly in residential, suggest that fortunes may be starting to turn.

“This uptick in activity is encouraging, but sustained recovery will depend on confidence filtering through the supply chain. The Government’s much-anticipated spending review in June will be a crucial moment. If it brings clarity on major infrastructure investment, it could unlock momentum not just for big-ticket schemes, but the smaller, local projects captured in this data too; the kind councils are waiting to greenlight.”

Taking a closer look at the sector verticals and regional outlook…

Sector Analysis – Residential

Residential construction saw a significant boost in the three months to April, with overall starts rising 24% compared to the previous quarter and up 22% on 2024 levels. This growth was driven by both private and social housing, which showed notable improvements.

Private housing starts surged 22% compared to the preceding three months, a 29% increase compared to last year.

Social housing also saw strong performance, with a 29% increase on the previous quarter, and standing 3% up on the same period in 2024.

Sector Analysis – Non-Residential

Community and amenity project-starts rose 21% compared to the previous three months, increasing 19% on the same period last year.

Health project-starts also saw a positive trend, rising 12% on the previous quarter and standing 2% up on the year before.

The office sector saw a significant boost, with starts soaring 61% compared to the preceding three months, and increasing 26% on 2024 levels, with the £54 million Blackpool Airport office relocation scheme providing a major uplift.

In contrast, retail and hotel & leisure projects performed poorly, with retail starts falling 19% against the previous quarter and down 33% on last year. The hotel & leisure sector similarly dropped 26% compared to the last quarter, and was down 25% on 2024.

Civil engineering work also declined, dropping 22% against both the preceding three months and the same period last year, with infrastructure projects, particularly utilities, showing the steepest drops.

Regional Outlook

The South West led regional performance, with construction starts rising 15% compared to the previous three months and climbing 29% on the same period last year.

Similarly, the South East saw strong growth, increasing 32% on the preceding quarter and rising 8% year-on-year.

London experienced a 22% increase in activity compared to the previous quarter, though it was still down 10% on the previous year.

The North West also saw an uplift, rising 25% against the preceding three months, but remained 20% behind 2024 figures.

The North East had a mixed performance, declining 4% against the previous quarter but standing 11% up compared to the previous year

The West Midlands had a more challenging quarter, with starts rising 16% against the preceding three months, but declining 6% on the same period in 2024.

To find out more about Glenigan and its construction intelligence services, click here.

Leave a Reply

Want to join the discussion?Feel free to contribute!