Slowest decline in UK construction output for four months

S&P Global UK Construction PMI®

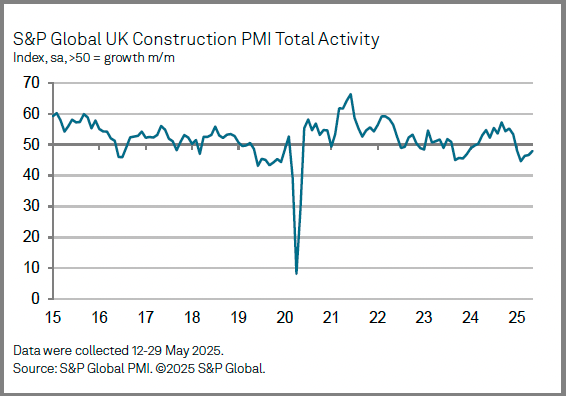

Moderate fall in total construction activity

Sharpest rate of job shedding since August 2020

Business activity expectations edge up in May

The downturn in the UK construction sector showed signs of easing in May. Output and new orders both fell at the slowest pace since January, while growth projections for the year ahead improved again.

Employment remained a weak spot, with job shedding accelerating to its fastest since August 2020.

The headline S&P Global UK Construction Purchasing Managers’ Index™ (PMI®) – a seasonally adjusted index tracking changes in total industry activity – posted 47.9 in May, up from 46.6 in April, to signal the slowest reduction in output volumes since January. Lower business activity has been recorded throughout 2025 to date, but the latest fall was only modest.

FOLLOW THIS LINK to the S&P Global UK Construction PMI

Comments:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

“The construction sector continued to adjust to weaker order books in May, which led to sustained reductions in output, staff hiring and purchasing. However, the worst phase of spending cutbacks may have passed as total new work fell at a much slower pace than the near five-year record in February.

“Housing activity was the weakest-performing segment in May as demand remained constrained by elevated borrowing costs and subdued confidence. Commercial work was close to stabilisation after a marked decline in April, suggesting that fears about domestic economic prospects have abated after the initial shock of US tariff announcements.

“Output growth expectations across the UK construction sector recovered to the highest so far in 2025. Survey respondents mostly cited a general improvement in sales projections as well as a potential tailwind from falling interest rates over the year ahead.

“On the inflation front, stubbornly high input price pressures were recorded in May, although the overall rise in purchasing costs was the least marked for four months. Many firms noted that suppliers continued to pass through greater payroll costs.

“Rising wages, squeezed margins and subdued demand weighed on construction employment, despite a brighter outlook for business activity. Job shedding was the steepest since August 2020, while subcontractor usage decreased to the greatest extent for five years.”

Gareth Belsham, director of Bloom Building Consultancy, commented:

“Few champagne corks will be popping at two months of slowing decline.

“But May’s modest improvement in the PMI data confirms that April’s bump was no blip. Some in the construction sector are now daring to hope that the worst is past.

“Certainly there’s a spring in the step of those focusing on commercial property. The PMI data confirms that commercial work is now the best-performing subsector, and on the project front-line we’re seeing some encouraging light at the end of the tunnel.

“In the past few weeks we’ve seen a number of commercial property investors who had paused at the ‘go / no’ point decide to press the button.

“Yet the progress is all relative. While it’s the stand-out performer in the PMI data, commercial construction activity is still technically in negative territory. And its modest shine is flattered by the sharper declines seen in housebuilding and civil engineering.

“Across the industry, sentiment is still finely balanced. 39% of the contractors surveyed predict that workloads will improve over the next 12 months. But an increase in the number of construction workers being laid off hardly speaks to an industry preparing for boom times.

“The official ONS data showed a big jump in the value of new orders placed in the first quarter of the year – up more than a quarter compared to Q4 2024 – and as these feed through into projects we will hopefully see these marginal improvements in the PMI data coalesce into genuine growth.

“These are baby steps – but they’re heading in the right direction.”

Dominic Crichton, senior quantity surveyor at Thomas & Adamson, part of Egis Group, said: “While the PMI reading shows that overall sector activity is still in decline, the fact that this has been the smallest dip for 2025 so far points towards a potential change of direction in the second half of the year.

“A general feeling of cautiousness remains for the meantime, with economic pressures and the impact of employment law changes being felt across the board. Staffing numbers have fallen sharply, which will only add to the industry-wide skills shortage that we are all familiar with. That said, one positive to take from today’s update is that commercial activity seems to be stabilising, which may offer a boost in the months ahead.

“Outcomes from the UK Government’s Spending Review next week may provide further clarity in terms of civil and infrastructure projects across the public sector, providing a confidence boost that many in the industry are seeking. Despite the near-term headwinds, the outlook for 2025 remains cautiously optimistic, and talks with our clients show pipelines are growing modestly and new opportunities are beginning to emerge.”

Leave a Reply

Want to join the discussion?Feel free to contribute!