ISG collapse is far worse than initial figures suggest

According to leading construction intelligence provider, Glenigan,

public sector work accounts for only a third of ISG’s pipeline

Glenigan data shows impact of ISG collapse is far worse than initial figures suggest

ISG’s recent collapse has sent shockwaves through the UK construction sector, placing many projects in peril and putting a number of subcontractors in a precarious position.

Whilst some analysts were quick to point out the scale of the problem especially for government projects, with a few days hindsight, it’s clear to see the impact was significantly underestimated, and will be felt across the whole of the construction sector for months to come.

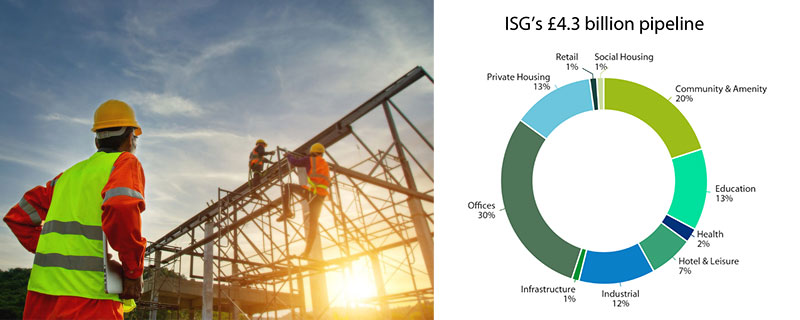

According to leading construction intelligence provider, Glenigan, public sector work accounts for only a third of ISG’s pipeline, while industrial, commercial and private housing projects on ISG’s books total over £2.8 billion.

Overall ISG currently has projects totalling over £2.5 billion on site and has been awarded contracts on a further £1.7 billion of work.

33 awarded contracts, 57 projects in progress on-site and 3 imminent completion, have been left up in the air. This includes:

| Project Name | Location | Value |

| Fujifilm Diosynth Biotechnologies Facility | Billingham, Cleveland | £200 million |

| Slough Data Centre Campus Phase 2 | Berkshire | £200 million |

| Institute of Neurology for UCL | London | £158 million |

| Data Center for Vantage Data Centers | Ealing | £150 million |

| Data Center for Colt Data Center Services | Hillingdon | £150 million |

ISG was also on 19 Construction Frameworks with a combined value of over £104 billion.

This situation presents a major problem for both contractors and subcontractors, many of which will be left seriously out of pocket, putting a large number of jobs on the line.

However, there is a commercial opportunity for agile suppliers to step into the breach, ensuring many of these projects do not fall behind and involved subcontractors are supported.

Commenting on these figures, Economic Director, Allan Wilen, says,

“ISG’s demise is set to dampen overall industry workload in the near term as clients look for contractors to complete projects currently on site and as recently awarded projects are re-tendered. Its subcontractors and suppliers will be under increased financial pressure and contractors’ nationwide will need to review and work with their own supply chains to minimise financial stress and avoid any additional loss of industry capacity.”

Leave a Reply

Want to join the discussion?Feel free to contribute!