S&P Global / CIPS UK Construction PMI ®

- KEY FINDINGS

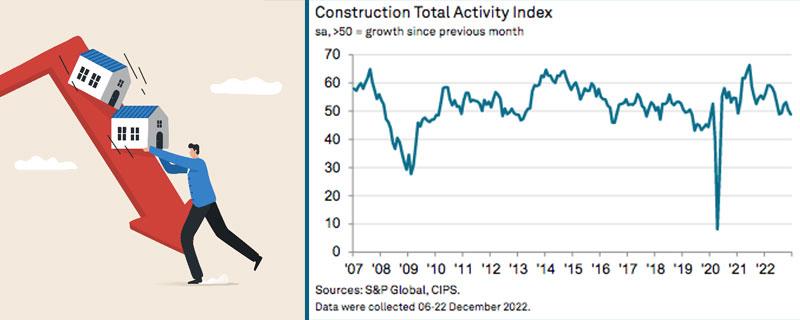

- Activity and new work decline at quickest rates since May 2020

- Firms cut jobs for first time since January 2021

- Business confidence turns negative

The UK’s construction sector recorded a fall in business activity during December, ending a three-month sequence of growth, with the rate of decline the fastest since May 2020. A similar trend was observed for new orders, which saw a renewed fall that was the strongest for over two-and-a-half- years.

Concurrently, sentiment amongst firms towards the year – ahead outlook for activity dipped into negative territory for only the sixth time on record, reflecting fears around the near-term economic outlook. Pessimistic expectations were reflected in the first round of job shedding in the construction sector since January 2021.

INDUSTRY COMMENTS:

Lewis Cooper, Economist at S&P Global Market Intelligence, which compiles the survey said:

“The UK’s construction sector registered a relatively poor finish to 2022, with business activity falling into decline following a three-month growth sequence amid the fastest contraction in new work since the initial pandemic period in May 2020. Companies cited weak client demand, driven partly by higher prices amid ongoing inflationary pressures. “Commercial construction activity remained the only bright spot, though here the rate of growth came close to stalling, with the overall contraction led by a further sharp decline in civil engineering and the first fall in residential construction activity since last July.

“The challenging environment in December was subsequently reflected in pessimism amongst firms towards activity levels over the coming year, with business confidence downbeat for only the sixth time since the

survey began in April 1997. “With the outlook turning negative, staffing levels declined for the first time since the start of 2021 in December. Though panellists primarily attributed the fall to the non-replacement of leavers, the data show that companies are preparing to face significant challenges in the months ahead.”

Fraser Johns, Beard finance director said: “While many within the industry would have been encouraged by the past few months of marginal growth in activity, news of a poor December and end to the year will come as no surprise given the deluge of challenges the sector is facing.

“The higher cost to borrow, tighter access to credit and wider inflationary pressures have had a major impact on client confidence. Contractors, who have seen higher material costs erode margins are now seeing the market for new work tighten, making tenders more competitive. While those with strong balance sheets may be able to stomach that, those already at risk face a difficult 12 months ahead.

“A rise in commercial construction activity – albeit only marginally, is certainly a positive to take from a challenging month. However, it may not be enough to rescue the general optimism of the sector, especially as civil engineering and residential construction stumbled. While resilience may be tested, the mantra has to be to “control what we can control” moving forward, working closely with developers, clients and stakeholders.”

Bill Roddie is MD of Glasgow-based Spectrum Properties.

Given the social, political and economic turmoil of the past three years, it would be a brave soul who would venture a cast-iron prediction, but of one thing we can be pretty sure: things are not going to return to pre-Covid levels for some time, if ever.

Price volatility is the new variable and the construction, housebuilding and private rental markets are going to have to factor it into their calculations somehow – along with inflation and interest rates – as they try to clear the fog in their crystal balls.

Housebuilding will be hit another hammer blow by the inevitable recession and, although ownership may remain tantalisingly out of reach for many, people will still want a home, so the build-to-rent market is likely to take off.

In a housing shortage of this magnitude, landlords should come into their own – filling a niche demand for those who cannot, or don’t want to, buy. It rather defies logic, therefore, for Governments – especially Holyrood – to weight the dice so heavily against them in the name of protecting tenants. This imbalance has yet to come home to roost.

Technology in construction will move briskly up the agenda as designers and planners shift their focus to sustainability and whole-life valuation of the built environment. Solar PV will become the norm on new build, where it is demonstrably the most effective.

Many people may want to reduce energy costs by installing solar on existing residential or commercial properties, but retro-fitting and supporting old roofs to accommodate panels can be very costly. And, like everything else in the world, the price of panels has soared, making them less attractive.

The skills shortage in construction and related areas is, I fear, only going to get worse. It is a sad fact that many young people are simply not interested in traditional jobs and, post-Covid, disturbing numbers of over-55s have reassessed their work life balance and walked away from full-time employment.

This is exacerbated by the fact that significant tranches of hard-working and reliable European staff have left the UK in recent years and it is anybody’s guess if they will ever come back.

We need stability and calm, and we may have it with the new Prime Minister. He will be well aware that energy supply will be the crucial factor in 2023 and will dominate both business and personal agendas.

Leave a Reply

Want to join the discussion?Feel free to contribute!