BSI’s annual Net Zero Barometer Report shows that almost half (49%) of UK senior decision makers are prioritising growth in their organization while one in five (20%) are prioritizing the reduction of carbon emissions.

While the proportion focused on carbon reduction represents a sizeable minority, many business leaders continue to find it hard to think about the net zero transition in a context where the UK economy slowly recovers from the effects of the pandemic and businesses try to address supply chain issues, inflationary pressures and labour shortages. Indeed only a fifth (21%) of those polled confirmed that they were fully aware of what net zero targets mean in practice for their organization.

The 2022 Net Zero survey of 1,000 senior decision makers and sustainability professionals did find a desire and an optimism that the UK can and will achieve its net zero goal. The majority of those surveyed (71%) had already set targets to meet net zero, and 78% were more convinced post-COP26 that reaching net zero targets was possible. This is a big step forward from BSI’s 2021 survey where only 40% of organizations had made a net zero commitment and a further 31% were “considering it”.

Despite this progress on targets and commitments, cost remains a significant barrier to implementation for many organizations. Almost half of decision makers (45%) cited cost as a barrier, clearly making it the leading challenge for organizations looking to reach net zero, above supply chain (29%) and regulation (25%).

Almost two-thirds (65%) of decision makers say they have accelerated efforts to operate at net zero as a result of the pandemic. There is a willingness to collaborate and learn to meet targets, with nearly three-quarters of those surveyed saying their organization is getting guidance from external sources, and 46% reporting that they would like more support.

Scott Steedman, Director-General, Standards at BSI said: “The COP26 summit in Glasgow and media coverage around that showed that many businesses are gearing up for the net zero transition, seeing competitive advantage in becoming more sustainable. On the other hand, business leaders are also having to deal with supply chain challenges, rising energy costs, labour shortages and high inflation. There is a big risk that industry overlooks the net zero transition in their quest for economic growth or even simply business survival.

“These pressures could easily create an either/or narrative for both businesses and consumers, a choice between cutting costs or cutting carbon. However, the evidence suggests businesses can do both, cut costs and cut carbon, and international standards are a prime tool to achieve this.

“As businesses become more efficient and self-sustaining, they become more resilient and their exposure to global events, whether supply chain uncertainty or energy prices, is lessened. Acting to address their social responsibilities will help to boost recruitment and retention. Collaborative working with other organisations can help reduce the cost of the net zero transition. Fundamentally, businesses should take a strategic view of the opportunities for growth and cost-savings that will come from building a decarbonized, sustainable organization. Net zero is a huge challenge, but also a huge opportunity.”

To analyse how UK businesses are managing the transition to net zero, BSI commissioned an independent survey of 1,000 UK senior decision makers and sustainability professionals across a range of industries to achieve a representative data sample. This the second annual survey.

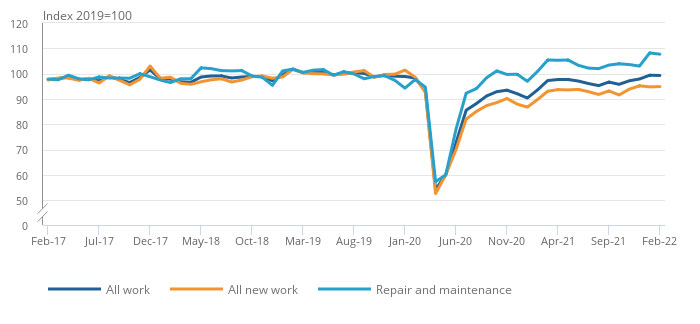

Public housing repair and maintenance was the only repair and maintenance sector to remain below its pre-coronavirus (COVID-19) level

Public housing repair and maintenance was the only repair and maintenance sector to remain below its pre-coronavirus (COVID-19) level