Playing your part in building the homes we need

July 30th: Earlier today, I set out to the House of Commons the Government’s plan to build the homes this country so desperately needs. Our plan is ambitious, it is radical, and I know it will not be without controversy – but as the Prime Minister said on the steps of Downing Street, our work is urgent, and in few areas is that urgency starker than in housing.

As the Leaders and Chief Executives of England’s local authorities, you know how dire the situation has become and the depth of the housing crisis in which we find ourselves as a nation. You see it as you place record numbers of homeless children in temporary accommodation; as you grapple with waiting lists for social housing getting longer and longer; and as your younger residents are priced out of home ownership.

It is because of this I know that, like every member of the Government, you will feel not just a professional responsibility but a moral obligation to see more homes built. To take the tough choices necessary to fix the foundations of our housing system. And we will only succeed in this shared mission if we work together – because it falls to you and your authorities not only to plan for the houses we need, but also to deliver the affordable and social housing that can provide working families with a route to a secure home.

To that end, and in a spirit of collaboration and of shared endeavour, I wanted to set out the principal elements of our plan – including what you can expect of the Government, and what we are asking of you.

Universal coverage of local plans

I believe strongly in the plan making system. It is the right way to plan for growth and environmental enhancement, ensuring local leaders and their communities come together to agree the future of their areas. Once in place, and kept up to date, local plans provide the stability and certainty that local people and developers want to see our planning system deliver. In the absence of a plan, development will come forward on a piecemeal basis, with much less public engagement and fewer guarantees that it is the best outcome for your communities.

That is why our goal has to be for universal coverage of ambitious local plans as quickly as possible. I would therefore like to draw your attention to the proposed timelines for plan-making set out in Chapter 12 of the National Planning Policy Framework (NPPF) consultation. My objective is to drive all plans to adoption as fast as possible, with the goal of achieving universal plan coverage in this Parliament, while making sure that these plans are sufficiently ambitious.

This will of course mean different things for different authorities.

- For plans at examination this means allowing them to continue, although where there is a significant gap between the plan and the new local housing need figure, we will expect authorities to begin a plan immediately in the new system.

- For plans at an advanced stage of preparation (Regulation 19), it means allowing them to continue to examination unless there is a significant gap between the plan and the new local housing need figure, in which case we propose to ask authorities to rework their plans to take account of the higher figure.

- Areas at an earlier stage of plan development, should prepare plans against the revised version of the National Planning Policy Framework and progress as quickly as possible.

I understand that will delay the adoption of some plans, but I want to balance keeping plans flowing to adoption with making sure they plan for sufficient housing. I also know that going back and increasing housing numbers will create additional work, which is why we will provide financial support to those authorities asked to do this. The Government is committed to taking action to ensure authorities have up-to-date local plans in place, supporting local democratic engagement with how, not if, necessary development should happen. On that basis, and while I hope the need will not arise, I will not hesitate to use my powers of intervention should it be necessary to drive progress – including taking over an authority’s plan making directly. The consultation we have published today sets out corresponding proposals to amend the local plan intervention criteria.

We will also empower Inspectors to be able to take the tough decisions they need to at examination, by being clear that they should not be devoting significant time and energy during an examination to ‘fix’ a deficient plan – in turn allowing Inspectors to focus on those plans that are capable of being found sound and can be adopted quickly.

Strategic planning

We know however that whilst planning at the local authority level is critical, it’s not enough to deliver the growth we want to see. That is why the Government was clear in the Manifesto that housing need in England cannot be met without planning for growth on a larger than local scale, and that it will be necessary to introduce effective new mechanisms for cross-boundary strategic planning.

This will play a vital role in delivering sustainable growth and addressing key spatial issues – including meeting housing needs, delivering strategic infrastructure, building the economy, and improving climate resilience. Strategic planning will also be important in planning for local growth and Local Nature Recovery Strategies.

We will therefore take the steps necessary to enable universal coverage of strategic planning within this Parliament, which we will formalise in legislation. This model will support elected Mayors in overseeing the development and agreement of Spatial Development Strategies (SDSs) for their areas. The Government will also explore the most effective arrangements for developing SDSs outside of mayoral areas, in order that we can achieve universal coverage in England, recognising that we will need to consider both the appropriate geographies to use to cover functional economic areas, and the right democratic mechanisms for securing agreement.

Across all areas, these arrangements will encourage partnership working but we are determined to ensure that, whatever the circumstances, SDSs can be concluded and adopted. The Government will work with local leaders and the wider sector to consult on, develop and test these arrangements in the months ahead before legislation is introduced, including consideration of the capacity and capabilities needed such as geospatial data and digital tools.

While this is the right approach in the medium-term, we do not want to wait where there are opportunities to make progress now. We are therefore also taking three immediate steps.

- First, in addition to the continued operation of the duty to cooperate in the current system, we are strengthening the position in the NPPF on cooperation between authorities, in order to ensure that the right engagement is occurring on the sharing of unmet housing need and other strategic issues where plans are being progressed in the short-term.

- Second, we will work in concert with Mayoral Combined Authorities to explore extending existing powers to develop an SDS.

- Third, we intend to identify priority groupings of other authorities where strategic planning – and in particular the sharing of housing need – would provide particular benefits, and engage directly with the authorities concerned to structure and support this cooperation, using powers of intervention as and where necessary.

Housing targets

Underpinning plan making – at the strategic and local level – must be suitably ambitious housing targets. That is why we have confirmed today that we intend to restore the standard method as the required approach for assessing housing needs and planning for homes, and reverse the wider changes made to the NPPF in December 2023 that were detrimental to housing supply.

But simply going back to the previous position is not enough, because it failed to deliver enough homes. So, we are also consulting on a new standard method to ensure local plans are ambitious enough to support the Government’s commitment to build 1.5 million new homes over the next five years. The new method sees a distribution that will drive growth in every corner of the country. This includes a stretching yet credible target for London, with what was previously unmet need in the capital effectively reallocated to see homes built in areas where they will be delivered. The new method increases targets across all other regions relative to the existing one, and significantly boosts expectations across our city regions – with targets in Mayoral Combined Authority areas on average growing by more than 30%.

I want to be clear that local authorities will be expected to make every effort to allocate land in line with their housing need as per the standard method, noting it is possible to justify a lower housing requirement than the figure the method sets on the basis of local constraints on land and delivery, such as flood risk. Any such justification will need to be evidenced and explained through consultation and examination, and local authorities that cannot meet their development needs will have to demonstrate how they have worked with other nearby authorities to share that unmet need.

And we are also committed to making sure that the right kind of homes are delivered through our planning system as quickly as possible. That is why we are proposing to remove the prescriptive approach to affordable home ownership products, which can squeeze out Social and Affordable rent homes despite acute need. This will free authorities to secure more Social Rent homes, ensuring you get the homes you need in your local areas. We also want to promote the delivery of mixed use sites which can include a variety of ownership and rental tenures, including rented affordable housing and build to rent, and which provide a range of benefits – including creating diverse communities and supporting timely build out rates.

Green Belt and Grey Belt

If targets tell us what needs to be built, the next step is to make sure we are building in the right places. The first port of call is rightly brownfield land, and we have proposed some changes today to support such development.

But brownfield land can only be part of the answer, which is why we are consulting on changes that would see councils required to review boundaries and release Green Belt land where necessary to meet unmet housing or commercial need.

I want to be clear that this Government is committed to protecting nature. That is why land safeguarded for environmental reasons will maintain its existing protections. But we know that large parts of the Green Belt have little ecological value and are inaccessible to the public, and that the development that happens under the existing framework can be haphazard – too often lacking the affordable homes and wider infrastructure that communities need. Meanwhile, low quality parts of the Green Belt, which we have termed ‘grey belt’ and which make little contribution to Green Belt purposes, like disused car parks and industrial estates, remain undeveloped.

We will therefore ask authorities to prioritise sustainable development on previously developed land and other low quality ‘grey belt’ sites, before looking to other sustainable locations for meeting this need. We want decisions on where to release land to remain locally led, as we believe that local authorities are in the best position to judge what land within current Green Belt boundaries will be most suitable for development. But we also want to ensure enough land is identified in the planning system to meet housing and commercial need, and so we have proposed a clear route to bringing forward schemes on ‘grey belt’ land outside the plan process where delivery falls short of need.

To make sure development on the Green Belt truly benefits your communities, we are also establishing firm golden rules, with a target of at least 50% of the homes onsite being affordable, and a requirement that all developments are supported by the infrastructure needed – including GP surgeries, schools and transport links – as well as greater provision of accessible green space.

Growth supporting infrastructure

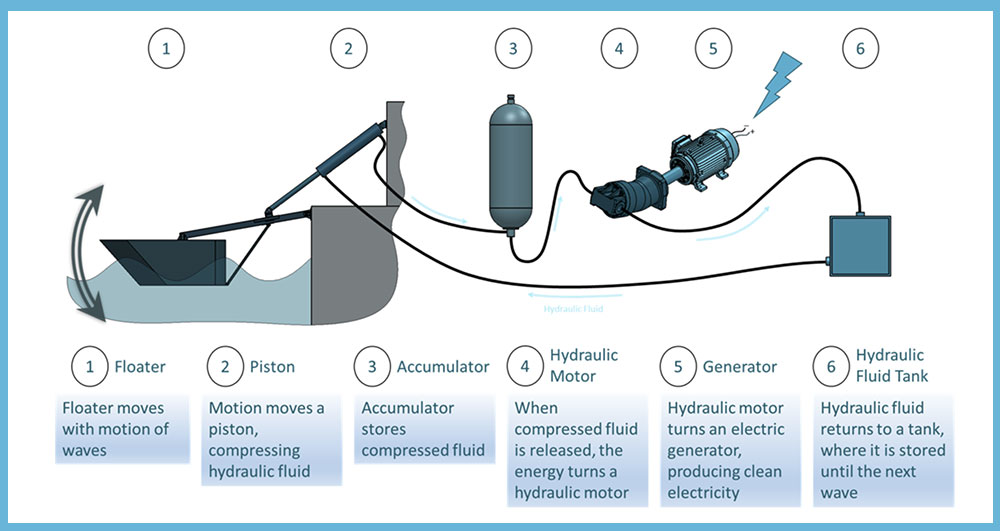

Building more homes is fundamental to unlocking economic growth, but we need to do so much more. That is why we are also proposing changes to make it easier to build growth-supporting infrastructure such as laboratories, gigafactories, data centres, electricity grid connections and the networks that support freight and logistics – and seeking views on whether we should include some of these types of projects in the Nationally Significant Infrastructure Projects regime.

Having ended the ban on onshore wind on our fourth day in office, we are also proposing to: boost the weight that planning policy gives to the benefits associated with renewables; bring larger scale onshore wind projects back into the Nationally Significant Infrastructure Projects regime; and change the threshold for solar development to reflect developments in solar technology. In addition, we are testing whether to bring a broader definition of water infrastructure into the scope of the Nationally Significant Infrastructure Projects regime.

And recognising the role that planning plays in the broader needs of communities, we are proposing a number of changes to: support new, expanded or upgraded public service infrastructure; take a vision-led approach to transport planning, challenging the now outdated default assumption of automatic traffic growth; promote healthy communities, in particular tackling the scourge of childhood obesity; and boost the provision of much needed facilities for early-years childcare and post-16 education.

Capacity and fees

I recognise that delivering on the above ambition will demand much from you and your teams, and your capacity is strained. We want to see planning services put on a more sustainable footing, which is why we are consulting on whether to use the Planning and Infrastructure Bill to allow local authorities to set their own fees, better reflecting local costs and reducing financial pressures on local authority budgets.

While legislative change is important, we also do not want to wait to get extra resource into planning departments – which is why I am consulting on increasing planning fees for householder applications and other applications, that for too long have been well below cost recovery. We know that we are asking a lot more of local authorities, and we are clear that this will only be possible if we find a way to give more resource.

It is also important that you are supported in the critical role you play when the infrastructure needed to kickstart economic growth and make Britain a clean energy superpower is being consented under the Nationally Significant Infrastructure Projects regime. I am therefore consulting on whether to make provision to allow host upper and lower tier (or unitary) authorities to recover costs for relevant services provided in relation to applications, and proposed applications, for development consent.

Social and affordable housing

Overhauling our planning system is key to delivering the 1.5 million homes we have committed to build over the next five years – but it is not enough. We need to diversify supply, and I want to make sure that you have the tools and support needed to deliver quality affordable and social housing, reversing the continued decline in stock. This is vital to help you manage local pressures, including tackling and preventing homelessness.

Within the current Affordable Homes Programme (AHP), we know that particularly outside London, almost all of the funding for the 2021-2026 AHP is contractually committed. That is why I have confirmed that we will press Homes England and the Greater London Authority (GLA) to maximise the number of Social Rent homes in allocating the remaining funding.

The Government will also bring forward details of future Government investment in social and affordable housing at the Spending Review, so that social housing providers can plan for the future and help deliver the biggest increase in affordable housebuilding in a generation. We will work with Mayors and local areas to consider how funding can be used in their areas and support devolution and local growth.

In addition, I have confirmed that the Local Authority Housing Fund (LAHF) 3 will be going ahead, with £450 million provided to councils to acquire and create homes for families at risk of homelessness. This will create over 2,000 affordable homes for some of the most vulnerable families in society.

I recognise that councils and housing associations need support to build their capacity if they are to make a greater contribution to affordable housing supply. We will set out plans at the next fiscal event to give councils and housing associations the rent stability they need to be able to borrow and invest in both new and existing homes, while also ensuring that there are appropriate protections for both existing and future social housing tenants.

As we work to build more affordable homes, we also need to do better at maintaining our existing stock – which is why I have announced three updates on the Right to Buy scheme:

- First, we have started to review the increased Right to Buy discounts introduced in 2012, and we will bring forward secondary legislation to implement changes in the autumn;

- Second, we will review Right to Buy more widely, including looking at eligibility criteria and protections for new homes, bringing forward a consultation also in the autumn; and

- Third, we are increasing the flexibilities that apply to how councils can use their Right to Buy

With respect to the third point, from today we are removing the caps on the percentage of replacements delivered as acquisitions (which was previously 50%) and the percentage cost of a replacement home that can be funded using Right to Buy receipts (which was also previously 50%). Councils will also now be able to combine Right to Buy receipts with section 106 contributions. These flexibilities will be in place for an initial 24 months, subject to review. My department will be writing to stock-holding local authorities with more details on the changes, and I would encourage you to make the best use of these flexibilities to maximise Right to Buy replacements and to achieve the right balance between acquisitions and new builds.

Finally, I would like to emphasise the importance of homes being decent, safe and warm. That is why this Government will introduce Awaab’s Law into the social rented sector. We will set out more detail and bring forward the secondary legislation to implement this in due course. We also intend to bring forward more detail in the autumn on our plans to raise standards and strengthen residents’ voices.

Next phase of reform

The action we have announced today will get us building, but as I said to the House of Commons it represents only a downpayment on our ambitions.

As announced in the King’s Speech, we will introduce a Planning and Infrastructure Bill later in the first session, which will: modernise planning committees by introducing a national scheme of delegation that focuses their efforts on the applications that really matter, and places more trust in skilled professional planners to do the rest; enable local authorities to put their planning departments on a sustainable footing; further reform compulsory purchase compensation rules to ensure that what is paid to landowners is fair but not excessive; streamline the delivery process for critical infrastructure; and provide any necessary legal underpinning to ensure we can use development to fund nature recovery where currently both are stalled.

We will consult on the right approach to strategic planning, in particular how we structure arrangements outside of Mayoral Combined Authorities, considering both the right geographies and democratic mechanisms.

We will say more imminently about how we intend to deliver on our commitment to build a new generation of new towns. This will include large-scale new communities built on greenfield land and separated from other nearby settlements, but also a larger number of urban extensions and urban regeneration schemes that will work will the grain of development in any given area.

And because we know that the housing crisis cannot be fixed overnight, the Government will publish a long-term housing strategy, alongside the Spending Review, which the Chancellor announced yesterday.

We have a long way to go, but I hope today proves to be a major first step for all of us as we seek to put the housing crisis behind us. I look forward to working with you all, and am confident that together, we can achieve significant improvements that will benefit our citizens.

Yours sincerely,

RT HON ANGELA RAYNER MP

Deputy Prime Minister and Secretary of State for Housing, Communities & Local Government