Pooling expertise key to safeguarding future water supply, says Egis as government fast-tracks new reservoirs

Egis in the UK has welcomed the announcement that the government will fast-track decisions about two new reservoirs and plans to change the law so that further reservoir projects are approved more quickly, but has cautioned that the industry’s challenges run deeper and demand wider collaboration.

The infrastructure and engineering business was responding to news that reservoirs in East Anglia and Lincolnshire will be treated as nationally significant infrastructure projects (NSIPs) and so will be subject to planning approval by ministers, rather than local councils.

Michael Timmins, Director of Water at Egis in the UK, said the approval by OFWAT of 30

‘Major Projects’ to be progressed over the next 10 to 15 years, combined with the effects of climate change, means collaboration is more important than ever.

“The complexity of the challenges facing our water industry cannot be overstated,” said Michael. “Whether it’s the construction of new reservoirs, new sewers, treatment plants or replacing aging pipes, the industry needs to shift towards new ways of working if it is to deliver the infrastructure upgrades that are needed to safeguard our water supply into the 2030s and beyond.

“Developing these new ways of working means drawing on a wider pool of expertise, which is a significant challenge against a background of acute skills shortages. That means the industry needs to look beyond the Tier 1 consultancies and make greater use of SME suppliers and those able to bring insights from successful water infrastructure upgrades overseas.”

The government’s decision to fast-track the approvals process for new reservoirs coincides with the start of the water industry’s Asset Management Period Eight (AMP8), which involves a total investment of £104 billion over the next five years – around twice that seen in the last five years.

Michael added: “There is a lot to do to bring the country’s water infrastructure up to where it needs to be. The government is right to be fast-tracking new reservoirs, but it also needs to ensure that the industry is drawing upon the deepest possible pool of expertise, including that possessed by those with experience of delivering major improvements in similar circumstances in countries like France and Ireland.”

A new study suggests that if cities want to continue to drive down levels of black carbon, they should switch their efforts from road transport to construction equipment.

The research, conducted at the top of the BT Tower in London, was undertaken by a team involving scientists from the University of Manchester, UK Centre for Ecology and Hydrology, University of York, Zhejiang University, and the National Centre for Atmospheric Science.

The research, conducted at the top of the BT Tower in London, was undertaken by a team involving scientists from the University of Manchester, UK Centre for Ecology and Hydrology, University of York, Zhejiang University, and the National Centre for Atmospheric Science.

The study looked at how much black carbon – which is essentially soot – is released into the air in central London during both summer and winter. Black carbon is emitted alongside other air pollutants during incomplete combustion and while its sources can range from brick kilns to residential energy and wildfires, in cities the major source has traditionally been road traffic.

In the BT Tower’s observatory, 35 floors up, the team collected air samples as they rose from the streets and buildings below. Using a method called eddy covariance, they could directly measure the pollution as it moved through the air in real-time.

This technique involves measuring wind speed and direction as well as the concentration of black carbon particles. By combining these two measurements, they can calculate the flux – the rate at which it is moving through the air. If more black carbon is going up than coming down, the area below the tower is a source of black carbon.

When black carbon in this area was measured in 2012, road traffic was clearly the predominant source but this is not the case now. Instead, the non-road mobile machinery (NRMM) used on construction sites – which are subject to far less stringent emission regulations than cars – have become a much more significant emitter, especially in areas with a higher concentration of construction work.

Dr James Allan, senior research scientist at the National Centre for Atmospheric Science and University of Manchester said:

‘We found only minimal emissions from traffic, which is consistent with emissions reductions associated with Euro 6, the standard for diesel engines specified by ULEZ.

‘This is in contrast to previous measurements in London, collected in 2012, which showed a strong association between traffic and black carbon. At the time, diesel particle filters had only been introduced relatively recently. And while domestic wood burning is also known to be a source of black carbon in the UK, this was predictably not found to be the case in central London which is mainly commercial rather than residential.’

‘We compared observed emissions with emission standards for construction equipment and found that even with compliance, black carbon output from generators, machinery and construction vehicles remains significant. Our work highlights how measurement techniques like eddy covariance can fill critical gaps in our understanding of urban pollution and support evidence-based strategies to protect public health and the environment.’

The full research can be read here.

Source: Air Quality News

The Last Mile group of multi-utility infrastructure companies is delivering a water-source ambient heat network at the mixed-use Welborne Garden Village development in Hampshire, England.

The first phase of the multi-phase project, delivered by Buckland Development, will see up to 700 homes, a primary school and a village centre comprising shops, pubs and cafes connected to Last Mile’s new ambient heat network. This network is expected to save residents an average of £160 per year for a typical three-bedroom house, compared to an air source heat pump alternative.

Wellborne Interior Heat Pump

The heat network uses a unique, first-of-its-kind technology in the UK. It draws stable temperature water from Portsmouth Water’s nearby underground Hoads Hill Reservoir and feeds it to an energy centre where a heat exchanger transfers energy from the water into an ambient heat network. Individual heat pumps at each property then convert that energy into space heating and hot water. The heat network serving the properties is a closed loop system, separate from the water network that circulates water from the reservoir to the energy centre. This ensures there is no risk to drinking water quality or supply.

It can also use the reservoir as a heat sink for cooling in warmer months and facilitates building-to-building heat transfer, transforming excess heat produced by cooling in one building into heat and hot water for other buildings. This makes it significantly more efficient than alternative heat solutions, resulting in 54% lower CO2 emissions than systems using air-source heat pumps and 80% less than gas boilers.

As Welborne’s master developer, Buckland has assembled a consortium committed to innovative technologies that encourage low carbon living in connected and energy efficient homes, integrated with extensive publicly accessible green spaces.

The Future Homes Standard is anticipated to require developers to reduce emissions for new homes by 75-80% compared to current standards. While many are focused on meeting this goal, few are comfortable with managing utilities once their developments are completed as this is not their traditional business model. Last Mile Heat is a joint venture between Last Mile and the heat network’s design and build partner Rendesco. Last Mile will own and manage the Phase 1 Welborne heat network, ensuring its efficient operation for the benefit of all residents.

Robin Abram, Associate Director, Last Mile Heat said:

“Ambient heat networks – whether using water or ground sources of heat – offer substantial emissions savings, and by adopting and managing the completed network we save developers significant operational expenditure. In many instances we can fund the build of the network too, reducing their upfront cost. As developers across the UK are under pressure to meet emissions reduction targets, Welborne Garden Village is a blueprint for success that many can follow.”

Last Mile Heat, a Heat Trust registered supplier, owns and operates the network and employs a dedicated team utilising 24/7 network monitoring to ensure availability and reliability of the network.

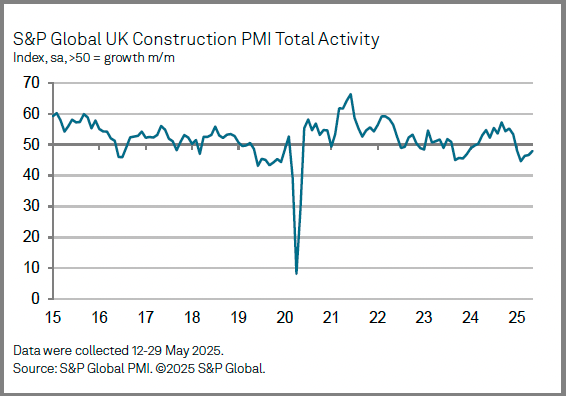

S&P Global UK Construction PMI®

Moderate fall in total construction activity

Sharpest rate of job shedding since August 2020

Business activity expectations edge up in May

The downturn in the UK construction sector showed signs of easing in May. Output and new orders both fell at the slowest pace since January, while growth projections for the year ahead improved again.

Employment remained a weak spot, with job shedding accelerating to its fastest since August 2020.

The headline S&P Global UK Construction Purchasing Managers’ Index™ (PMI®) – a seasonally adjusted index tracking changes in total industry activity – posted 47.9 in May, up from 46.6 in April, to signal the slowest reduction in output volumes since January. Lower business activity has been recorded throughout 2025 to date, but the latest fall was only modest.

FOLLOW THIS LINK to the S&P Global UK Construction PMI

Comments:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

“The construction sector continued to adjust to weaker order books in May, which led to sustained reductions in output, staff hiring and purchasing. However, the worst phase of spending cutbacks may have passed as total new work fell at a much slower pace than the near five-year record in February.

“Housing activity was the weakest-performing segment in May as demand remained constrained by elevated borrowing costs and subdued confidence. Commercial work was close to stabilisation after a marked decline in April, suggesting that fears about domestic economic prospects have abated after the initial shock of US tariff announcements.

“Output growth expectations across the UK construction sector recovered to the highest so far in 2025. Survey respondents mostly cited a general improvement in sales projections as well as a potential tailwind from falling interest rates over the year ahead.

“On the inflation front, stubbornly high input price pressures were recorded in May, although the overall rise in purchasing costs was the least marked for four months. Many firms noted that suppliers continued to pass through greater payroll costs.

“Rising wages, squeezed margins and subdued demand weighed on construction employment, despite a brighter outlook for business activity. Job shedding was the steepest since August 2020, while subcontractor usage decreased to the greatest extent for five years.”

Gareth Belsham, director of Bloom Building Consultancy, commented:

“Few champagne corks will be popping at two months of slowing decline.

“But May’s modest improvement in the PMI data confirms that April’s bump was no blip. Some in the construction sector are now daring to hope that the worst is past.

“Certainly there’s a spring in the step of those focusing on commercial property. The PMI data confirms that commercial work is now the best-performing subsector, and on the project front-line we’re seeing some encouraging light at the end of the tunnel.

“In the past few weeks we’ve seen a number of commercial property investors who had paused at the ‘go / no’ point decide to press the button.

“Yet the progress is all relative. While it’s the stand-out performer in the PMI data, commercial construction activity is still technically in negative territory. And its modest shine is flattered by the sharper declines seen in housebuilding and civil engineering.

“Across the industry, sentiment is still finely balanced. 39% of the contractors surveyed predict that workloads will improve over the next 12 months. But an increase in the number of construction workers being laid off hardly speaks to an industry preparing for boom times.

“The official ONS data showed a big jump in the value of new orders placed in the first quarter of the year – up more than a quarter compared to Q4 2024 – and as these feed through into projects we will hopefully see these marginal improvements in the PMI data coalesce into genuine growth.

“These are baby steps – but they’re heading in the right direction.”

Dominic Crichton, senior quantity surveyor at Thomas & Adamson, part of Egis Group, said: “While the PMI reading shows that overall sector activity is still in decline, the fact that this has been the smallest dip for 2025 so far points towards a potential change of direction in the second half of the year.

“A general feeling of cautiousness remains for the meantime, with economic pressures and the impact of employment law changes being felt across the board. Staffing numbers have fallen sharply, which will only add to the industry-wide skills shortage that we are all familiar with. That said, one positive to take from today’s update is that commercial activity seems to be stabilising, which may offer a boost in the months ahead.

“Outcomes from the UK Government’s Spending Review next week may provide further clarity in terms of civil and infrastructure projects across the public sector, providing a confidence boost that many in the industry are seeking. Despite the near-term headwinds, the outlook for 2025 remains cautiously optimistic, and talks with our clients show pipelines are growing modestly and new opportunities are beginning to emerge.”

The Labour government have announced thousands of homes will be built across the country due to simpler planning rules, but one industry body warns that easing planning rules alone won’t solve the housing crisis.

Deputy Prime Minister and Housing Secretary, Angela Rayner, says the current system makes it far too difficult for smaller builders to get spades in the ground, and claims the new rules will help deliver Labour’s promise of 1.5 million homes.

However, Propertymark say Angela Rayner’s housing plans need to be backed by broader reforms.

Remove red tape

Under new rules proposed by the Labour government, small housing developments of up to nine homes will now face eased Biodiversity Net Gain (BNG) requirements, and decisions will be made by expert planning officers rather than planning committees.

A new ‘medium site’ category will also be introduced, covering developments of 10 to 49 homes. These sites will face fewer regulations and reduced costs, including a proposed exemption from the Building Safety Levy and simplified BNG rules. Labour says this approach will make it easier to create biodiverse habitats while accelerating the delivery of much-needed homes.

Ms Rayner says these new rules will remove unnecessary barriers and red tape.

She said: “Smaller housebuilders must be the bedrock of our Plan for Change to build 1.5 million homes and fix the housing crisis we’ve inherited – and get working people on the housing ladder.

“For decades, the status quo has failed them and it’s time to level the playing field.

“We are taking urgent action to make the system simpler, fairer and more cost-effective, so smaller housebuilders can play a crucial role in our journey to get Britain building.”

Need a process that considers the wider picture

However, Propertymark warn simpler planning rules are not enough without wider reform in the housing sector.

Nathan Emerson, chief executive of Propertymark, said: “Keeping pace with housing demand remains an incredibly challenging ambition to achieve. It is important to review the entire homebuilding process from top to bottom to help ensure the process identifies areas of potential housing need and delivers a streamlined process that supports the provision of sustainable housing.

“We currently have the Planning and Infrastructure Bill working its way through Westminster; however, this still has some distance to go before it becomes law. Ultimately, we need a process that considers the wider picture, and it is important to factor in the creation of a workforce that brings the required skillsets to construct much needed new homes. It is also crucial to establish a materials supply chain that brings efficiency and consumer value.”

He adds: “From planning to completion, each aspect of the process must work in harmony via sector-wide collaboration, as the challenge is not just about the physical laying of bricks. There needs to be a system that has a true focus on supporting and inspiring housing developers of all scales to deliver new housing stock at an enhanced pace, however there must be equally robust backing for all others involved in the delivery process of new homes also.”

Source: Property 118

New Sustainable Packaging Debuts at Scotland’s First Net-Zero College

Trial Success of Geopak™ at Fife College Sparks Full Rollout

- Whitecroft Lighting unveils Geopak™, a reusable packaging solution set to eliminate 100,000 cardboard boxes from the supply chain over the next two years.

- Successful trial with Balfour Beatty at Scotland’s first Net-Zero college saved two tonnes of waste.

- £6,000 in waste management savings achieved at Fife College.

- Geopak™ unit is reusable at least 12 times, significantly cutting site waste and eliminating single-use plastics.

Whitecroft Lighting is transforming construction site sustainability with the official rollout of its smart, reusable packaging solution, Geopak™.

Designed to cut waste and help developers track valuable lighting assets, the innovation follows a highly successful trial with Balfour Beatty on a multi-million-pound Net-Zero project in Scotland.

Whitecroft says that by using the new Geopak™ system to package and transport its commercial lighting components, construction sites will eliminate tonnes of traditional carboard packaging waste, half of which is incorrectly recycled on-site, and will drastically reduce the amount of single-use wrapping used for securing boxes on pallets.

It will also save thousands of pounds in waste management costs.

Geopak™ features a modular tote box system, made from recycled materials, designed to securely and efficiently package up to 90% of Whitecroft’s lighting range. By maximising space and reducing unnecessary packaging, it streamlines transportation and cuts waste, improving sustainability and circularity in the construction sector.

Once emptied, the totes fold flat and are returned to Whitecroft, where they can be reused for multiple projects at least 12 times, making the system sustainable, circular and cost-effective. Because Geopak™ is modular, the totes can be repurposed for various projects and packaging needs.

To prevent misplaced deliveries of its valuable products, Geopak™ features GPS-enabled tags that can be tracked on-site using geofencing to an accuracy of two to three metres. This enables developers to track each shipment in real-time and determine the precise location for efficient on-site storage, stock management, and installation.

Finally, the GPS tags also ensure that Whitecroft can quickly retrieve the collapsed Geopak™ totes for reuse in future deliveries.

Whitecroft Lighting, which is known for its pioneering sustainable and circular lighting solutions, designs products that can be refurbished, repurposed, redistributed, and ultimately recycled at the end of life.

Extending these values to packaging and transportation, Whitecroft developed the Geopak™ system in collaboration with Cardiff University and consultants PDR, mapping the entire journey, from production to installation.

The innovative concept was then put into action through a partnership with Balfour Beatty, debuting during the construction of Fife College’s new multi-million-pound Learning Campus in Dunfermline, Scotland, which will be a Net-Zero project.

Jim Brannan, Head of Supply Chain Development, Balfour Beatty, explained why the company wanted to work with Whitecroft on the development of Geopak™:

“What is particularly inspiring about working on the Geopak™ project with Whitecroft is that it is not just about recycling or reusing packaging material, or even striving to meet a Net Zero carbon target. It’s about rethinking and reimagining our processes and innovating right from the design stage to the manufacturing of materials, through to the construction.”

Brannan added: “By collaborating, we planned a process and created a solution that addressed all the practical needs of each stakeholder but ultimately would help to reduce the carbon footprint of the Learning Campus development. By working together, I am proud to say that Fife College project was the first time Geopak™ was used commercially.”

Whitecroft and Balfour Beatty estimate that Geopak™ saved two tonnes of packaging waste on the Fife College project, cutting thousands in site costs, while GPS tracking reduced the risk of lost or damaged stock, streamlining storage and installation.

Now adopted on multiple high-profile projects, Geopak™ appeals to a wide range of stakeholders, from developers, architects and installers, through to project managers and property owners, because of for its sustainability benefits and tracking of expensive assets, as well as the cost savings it can help deliver. Whitecroft says using Geopak™ will take the equivalent of 100,000 cardboard cartons out of the supply chain over the next two years.

Matt Paskin, Solutions and Marketing Director, Whitecroft Lighting, explained:

“Sustainability and circularity are important to Whitecroft Lighting, so we have developed a range of energy-efficient products, reduced embodied carbon in our manufacturing and designed products that can be reused and then recycled to minimise end-of-life waste.

“With Geopak™, we are taking these philosophies to the next level by combining circularity with digitalisation when developing new buildings or retrofitting existing ones. We aim to implement Geopak™ on all our major projects to help our partners meet their waste reduction targets, boost site efficiency, and use data insights to reduce the build programme.”

Visit the Geopak page for more information.

Energetics completes low-carbon residential heat network for Cruden Homes

Innovative funded model for decentralised ambient ground-source heat network reduces capital investment for developers

Energetics, part of the Last Mile group of multi-utility infrastructure companies, announced it has completed and energised a low-carbon ground source heat network at a residential development in Barnton, near Edinburgh.

The Avenue, Barnton, consists of 48 luxury homes designed for retirement living. Cruden Homes, the developer, received a NextGeneration Project Gold award in recognition of the scheme’s outstanding environmental credentials; with the low-carbon heat network playing a key role in helping to exceed mandatory sustainability standards.

Energetics installed a ground source heat network that will result in 80% lower carbon emissions than traditional gas-fired heating, and 54% lower emissions than air-source technology. The highly efficient heat network takes its heat from an array of 18 vertical boreholes. A network of pipes, manifolds and valves then distribute that ambient heat from the boreholes to heat pump units that provide space and water heating to each home.

Although Cruden Homes wanted to move away from gas with a low-carbon heating solution, they were concerned about the upfront cost of installing a heat network. Energetics supported the development by providing a finance model to fund the capital cost of the heat network build. Cruden Homes benefitted from a 60% capital cost saving, while residents enjoy low running costs and a fixed-rate tariff. Last Mile will own, operate and maintain the heat network.

Kirsty Henderson, Head of Design and Sustainabililty, Cruden Homes, said:

“Energetics assigned a dedicated team to coordinate the design and build process to ensure that all electricity, water and heat network services were completed in line with our construction schedules. The team’s professional guidance was invaluable in helping us to meet our sustainability goals.”

“As developers are increasingly searching for alternatives to gas for home heating, the award-winning Barnton development showcases the economic and sustainability benefits of ground source heat networks,” said Lisa Gunn, Associate Director of Sales, Energetics. “We look forward to working with Cruden Homes on future developments.”

ENERGETICS CLICK HERE

Underground vs. overhead lines

New Whitepaper Challenges UK’s Over-Reliance on Overhead Power Lines: Calls for Strategic Shift to Underground Cabling – Crossed Wires: Rethinking the UK’s Energy Infrastructure Debate offers evidence-based solutions to modernise the grid whilst protecting landscapes and boosting resilience.

As the UK races to meet its net-zero targets, a whitepaper produced by Centriforce, Crossed Wires: Rethinking the Underground vs Overhead Debate, urges policymakers and industry leaders to reconsider the default reliance on overhead transmission lines (OHL) in the national electricity network.

Currently, the UK depends on 4,500 miles of overhead lines, compared to just 900 miles of underground cables, despite growing evidence that buried infrastructure can reduce visual blight, enhance resilience, and align with environmental goals. The whitepaper argues for a more balanced approach, blending overhead and underground solutions to create a grid fit for the 21st century.

The Case for Change

Overhead lines, whilst cheaper to install, face mounting criticism for their impact on landscapes, vulnerability to extreme weather and risks to wildlife and workers. Meanwhile, projects like the North Wessex Downs and Cotswolds National Landscape demonstrate how undergrounding can restore natural beauty without compromising reliability. The National Grid’s £500 million Visual Impact Provision fund has already begun removing pylons in 2024.

Key Findings:

- Environmental & Aesthetic Benefits: Underground cables eliminate visual intrusion in protected areas like AONBs and National Parks.

- Resilience Gains: Buried lines are less prone to storm damage, reducing outage risks.

- Innovation in Cost & Safety: Advances like the Centriforce Stokbord® Utility system (used in the Dogger Bank Wind Farm) have slashed installation time by 30x and improved worker safety.

A Balanced Future

The whitepaper acknowledges challenges—undergrounding can cost 5x more than OHL, and faults are harder to locate. Yet it argues that strategic deployment, particularly in urban and ecologically sensitive areas, could deliver long-term value.

“This isn’t about burying every cable,” says Jonathan Pearce, CEO, “but about smarter planning. As the nation builds a net-zero grid, we must weigh short-term savings against lasting impacts on communities, nature, and resilience.”

Download the Whitepaper

For data-driven analysis, case studies, and policy recommendations, access the full report.

Government has not yet confirmed funding for the boiler upgrade scheme and broader ‘warm homes plan’ beyond next year

The rollout of heat pumps will slow down and could cost the Government more if funding is cut at the spending review next week, industry experts have warned.

Grants of £7,500 are currently available for households that want to replace a gas boiler with a heat pump, which is considered more environmentally friendly because it runs on electricity.

But funding for the boiler upgrade scheme expires next year, with future budgets dependent on the Treasury committing more money at the spending review on 11 June.

The Government has promised to unveil a Warm Homes Plan in the coming months, with details about how to promote the uptake of heat pumps and other forms of green household energy, as well as helping people insulate their homes better to save on power.

Labour pledged a total budget of £13.2bn, half of which was due to be new funding, but that is now in doubt.

Large and small firms involved in the manufacturing and installation of heat pumps urged the Department for Energy Security and Net Zero (DESNZ), led by Energy Secretary Ed Miliband, to keep its promises.

Ministers have said that in due course, a large majority of houses should be equipped with heat pumps and have also committed to decarbonising the electricity grid by 2030, in a bid to slash the amount of CO2 emissions caused by home heating in the UK.

Pamela Brown of Aira, a Swedish company dubbed the “Spotify of heat pumps” because it runs a subscription model, said the state support was “absolutely critical” to encouraging uptake and praised the UK’s policies as the best of any market the firm works in.

She told The i Paper:

“Is it important for our business to have plans like the Warm Homes Plan? I believe it is. Number one, a boiler upgrade scheme is a strong motivator for people to make the switch. The financial incentive really helps.”

Emma Bohan, who runs a small installation firm in Derbyshire called IMS Heat Pumps, said:

“The current support provided by the boiler upgrade scheme has been one of the most successful schemes the Government have launched in support of delivering heat pumps, having funded 49,000 since its launch.

“To even consider that that might be part of a swingeing cut that they need to make under their funding commitments would have a massive impact on me and other installers.”

She added: “The consumers on the ground need to understand that the Government believes this. Otherwise, you create space for the climate change deniers and the fossil fuel industry to maintain that grip, which weakens our energy security and stops the growth happening in what is clearly a really exciting and innovative sector.”

Another industry source said:

“The Government seems to be taking some inevitably short-term decisions to try and scrimp a few pennies.”

Richard Warren of Truro-based company Kensa said that investment decisions were “all about certainty” and warned: “You need to get to a scale to push costs down significantly, and if you reduce investment you are not necessarily going to get that scale and you will not save money in the long term.”

Under pressure from Labour MPs and anti-poverty campaigners, ministers are preparing to bring back the winter fuel payment for more pensioners.

By Hugo Gye inews Political Editor

Source: inews

Building Specifier is an information portal for all professional building specifiers. We bring you the latest construction news from around the UK and the rest of the world.