Joe Bradbury examines the impact of the digital transformation on construction:

For decades, construction has been told that “digital transformation” will change everything. We’ve already seen the impact of Building Information Modelling (BIM), drones, laser scanning, and AI-driven tools for site management. Yet, beneath the surface, an even greater revolution is forming: the combination of quantum computing and artificial intelligence (AI).

Together, these technologies promise to tackle problems that the industry has long treated as too complex to solve—optimisations involving schedules, materials, logistics, carbon, and cost. The effect could be profound: faster programmes, lower emissions, reduced costs, fewer delays, and even new architectural forms that today would seem impossible.

Why quantum matters to construction

Unlike conventional computers, which process information in binary (1s and 0s), quantum computers use qubits that can hold multiple states at once. This makes them exceptionally good at solving “combinatorial problems”—situations where there are countless possible solutions, and finding the best one is nearly impossible with today’s systems.

Construction is riddled with such challenges. From sequencing thousands of trades on a large site, to coordinating offsite deliveries, to balancing carbon, cost and performance in design, these are exactly the types of problems quantum computing is built for. Pair this with AI—already transforming construction today—and the potential multiplies.

Where AI is already reshaping UK projects

To understand where quantum may take us, it helps to see where AI is already embedded:

Reality capture and progress tracking

Contractors on UK data centre and healthcare schemes are using AI-powered reality capture to transform site management. Regular 360° photo walks are automatically processed into measurable progress records, clash detection, and snagging reports. This creates a living, searchable digital record of the build, reducing disputes and speeding up decision-making.

AI for hospital construction

On NHS projects, AI-driven tools are being used to compare actual installation progress against digital plans. This allows teams to track thousands of individual components and spot delays or errors in real time. The result is more predictable delivery on projects where timing and compliance are critical.

Megaproject intelligence

Large-scale projects, such as HS2, have trialled AI for estimating carbon and costs across vast programmes. By learning from past data and running millions of comparisons, these systems identify where the biggest savings can be made—an approach that quantum computing could accelerate dramatically in the future.

Smarter building operations

In commercial offices, AI-driven energy management systems are already reducing HVAC energy use by double-digit percentages. By predicting occupancy patterns and weather, these platforms automatically adjust settings to save energy while maintaining comfort.

These case studies matter because they create the structured data and workflows that quantum systems will eventually supercharge.

Quantum pilots: early signs of the future

Although still in its infancy, quantum computing is already being tested in construction-adjacent fields:

HVAC optimisation

Researchers and industry partners have demonstrated quantum methods for optimising heating, ventilation, and cooling system design in complex buildings. Early results suggest measurable reductions in both cost and energy use—especially in dense, highly serviced buildings.

Prefabrication and logistics

Academics are exploring how quantum optimisation can improve production scheduling, inventory control, and delivery routing in modular construction. For factories and offsite providers, even small percentage improvements in takt time or delivery efficiency can translate into significant cost and programme savings.

Structural optimisation

Quantum-inspired algorithms have been tested on structural design problems, such as sizing members or finding optimal layouts. This could lead to lighter, more resilient structures, balancing performance and sustainability in ways current methods cannot.

In short: quantum computing is already moving beyond laboratory demonstrations into targeted use cases highly relevant to the built environment.

The hybrid model: AI as the guide, quantum as the engine

In practice, the two technologies will work together. AI excels at framing problems, cleaning data, and narrowing down possible solutions. Quantum computing then takes on the hardest optimisation tasks, exploring vast solution spaces at speeds classical computing cannot match. The results feed back into AI models, which refine and improve over time.

Likely first applications in construction

Planning and sequencing

Programme managers wrestle with millions of possible sequences for labour, cranes, and deliveries. AI already helps flag risks and suggest alternatives, but quantum will make it possible to explore every option quickly, balancing time, cost, and resources simultaneously.

Generative design

Today’s generative design tools already create thousands of variations for a building or structure. Add quantum computing, and designers will be able to test material, carbon, and cost trade-offs at unprecedented speed, producing solutions that would otherwise remain hidden.

Energy and building management

AI-enabled building management systems are cutting energy use. Quantum-enhanced versions could go further, optimising HVAC, on-site storage, and flexible loads minute-by-minute against fluctuating energy prices and carbon signals.

Offsite logistics

For modular and offsite projects, scheduling and routing are among the biggest challenges. Quantum algorithms could ensure factory production runs without disruption, while just-in-time deliveries arrive in exactly the right order for installation.

How this could revolutionise UK construction

If we look a few years ahead, the effects could be transformative:

Shorter pre-construction phases

Weeks instead of months to reach a value-tested, risk-analysed scheme. AI generates design options, quantum filters them for feasibility, carbon, and cost, leaving project teams with only the strongest candidates to review.

Carbon as a controllable factor

Instead of treating carbon as an afterthought, AI+quantum could optimise every decision—materials, supply chain, site logistics—against a live carbon budget, while still balancing time and cost.

Digital twins that act, not just display

Today, most digital twins are dashboards. In the future, they could become decision-making engines, proposing and implementing adjustments in real time, from energy use to traffic flow.

Supply chains transformed

With greater certainty in planning and sequencing, procurement models will change. More prefabrication, earlier package locking, and fewer disputes may follow as the industry learns to trust plans that are mathematically proven to be optimal within set constraints.

Barriers to adoption

It’s important not to get swept away by the hype. Quantum computing is still in its early stages, and hardware is limited. Near-term benefits will often come from “quantum-inspired” algorithms running on traditional machines. Access will most likely be through cloud services, in much the same way firms rent server capacity today.

Data quality is another hurdle. AI and quantum both require well-structured, reliable data to perform effectively. Contractors investing in robust digital capture and modelling workflows today will be first in line to benefit tomorrow.

Skills are also critical. New roles will be needed—people who understand not only construction but also optimisation, data science, and digital ethics.

Practical steps for 2025

For construction firms wanting to prepare:

Choose a high-impact optimisation problem such as crane scheduling, HVAC efficiency, or modular delivery sequencing.

Deploy AI tools that already deliver proven benefits—progress capture, risk prediction, energy tuning—and use them to improve data quality.

Engage with universities and tech providers to run small-scale pilots using quantum or quantum-inspired algorithms.

Integrate findings into digital twins, ensuring improvements aren’t one-offs but part of a growing knowledge base.

In summary

Artificial intelligence is already altering how we design, manage, and operate buildings. Quantum computing won’t replace AI—it will amplify it. Together, they could allow us to make decisions with a speed and precision never seen before in construction.

For an industry under pressure to deliver more housing, greener infrastructure, and better value for money, this is more than a futuristic talking point. It could be the foundation of the next great leap in how Britain builds.

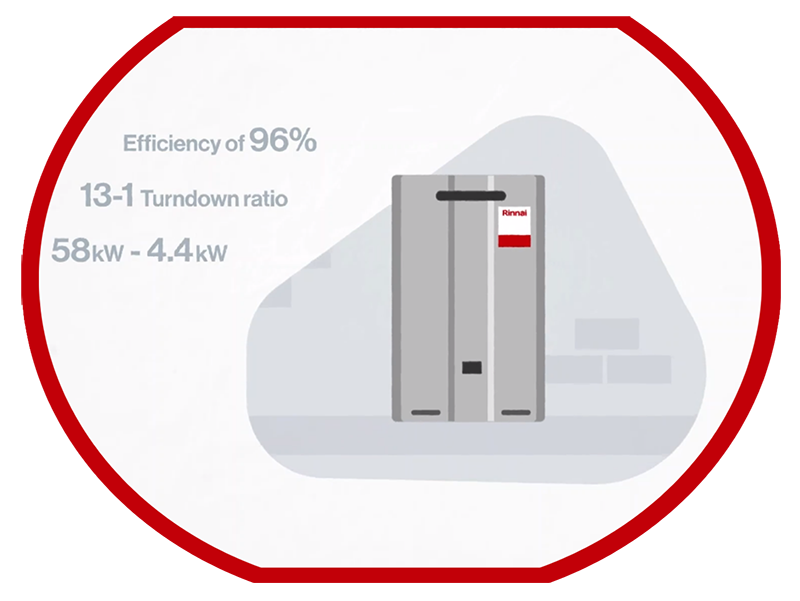

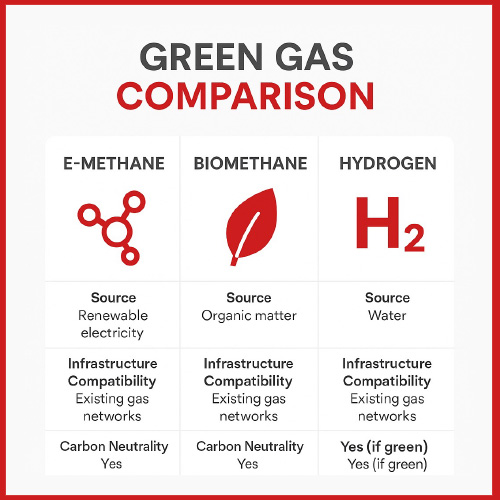

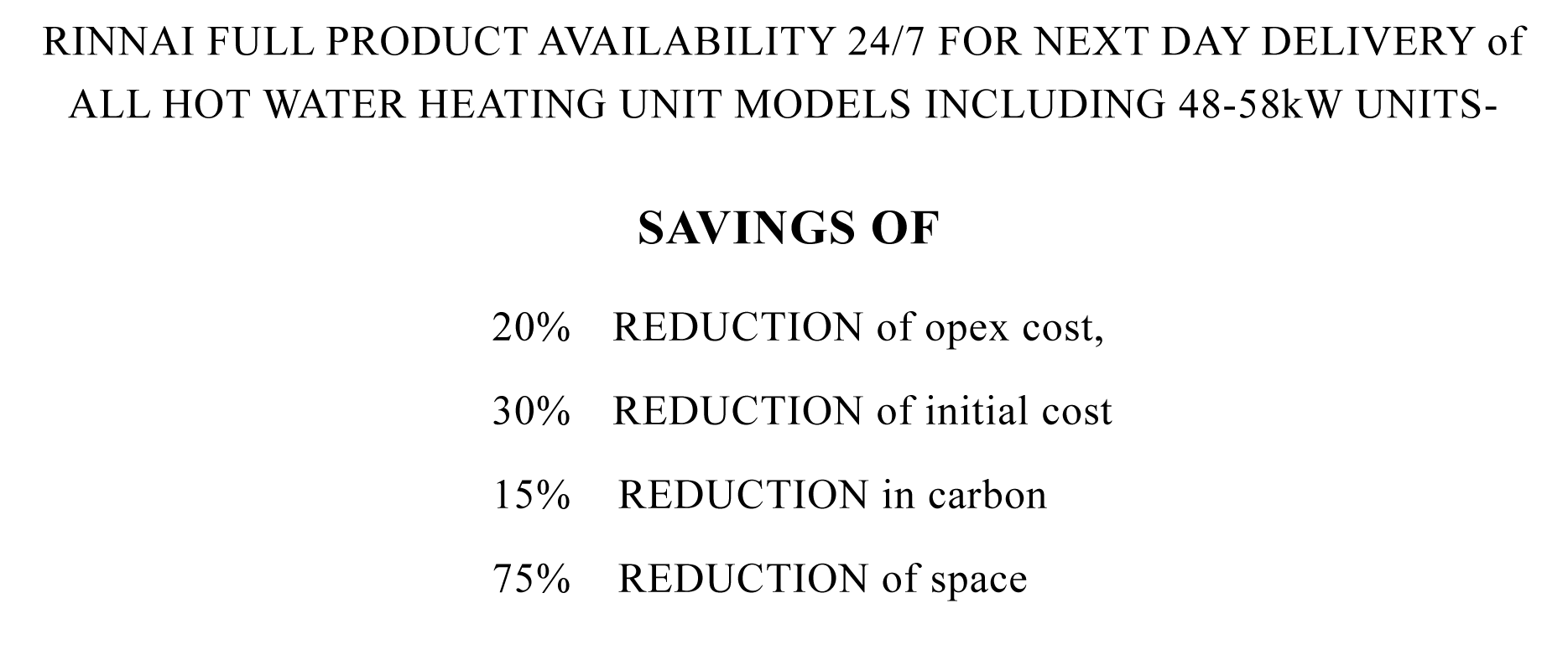

Chris Goggin observes how the UK procures its energy and the complexity in which it is then distributed and reacquired. As the UK progresses towards NetZero Rinnai looks to assist the industry in understanding what roles specific energies will fulfill and what approach the UK utilizes towards both the national and international energy markets.

Chris Goggin observes how the UK procures its energy and the complexity in which it is then distributed and reacquired. As the UK progresses towards NetZero Rinnai looks to assist the industry in understanding what roles specific energies will fulfill and what approach the UK utilizes towards both the national and international energy markets.

Limited range and charging infrastructure

Limited range and charging infrastructure

What are popular products/ranges amongst your customers?

What are popular products/ranges amongst your customers?