Construction Activity Falters in January

All three categories of construction work see a reduction in output during January

Renewed downturn in construction order books Cost inflation accelerates to a 21-month high

A modest fall in total industry output was recorded at the start of the year, thereby ending a 10-month period of sustained expansion. Shrinking order books and rising cost pressures contributed to the weakest business activity expectations since October 2023.

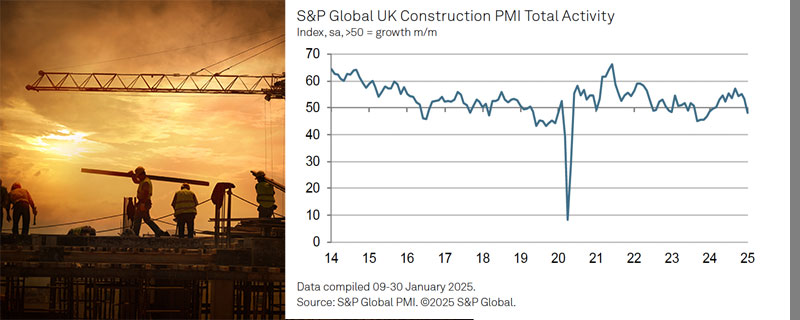

At 48.1 in January, down sharply from 53.3 in December, the headline seasonally adjusted S&P Global UK Construction Purchasing Managers’ Index™ (PMI®) – an index tracking changes in total industry activity – registered below the 50.0 no-change threshold for the first time since February 2024.

Construction companies cited delayed decision-making by clients on major projects and general economic uncertainty had weighed on business activity at the start of 2025. A number of firms also commented on the impact of subdued market conditions in the residential building sector. Latest data showed that house building (index at 44.9) decreased for the fourth successive month and at the fastest pace since January 2024.

Civil engineering activity (44.6) declined at a relatively sharp rate, although this partly reflected disruptions from unusually wet weather at the start of the year. Meanwhile, output in the commercial construction category also returned to contraction in January (48.9). This was linked to a lack of tender opportunities and a reluctance among clients to commit to new projects.

January data pointed to a decline in incoming new work for the first time in 12 months. Although only modest, the rate of contraction was the steepest since November 2023. Anecdotal evidence suggested that a lack of confidence among clients and worries about the UK economic outlook had contributed to fewer sales enquires.

Purchasing activity decreased for the second month in a row, reflecting weak order books and a lack of new work to replace completed projects. Despite softer demand for construction products and materials, the latest survey indicated the steepest rise in input costs since April 2023. Construction companies noted that suppliers had sought to pass on rising energy, transportation and staff costs. Moreover, vendor performance deteriorated to the greatest extent for two years, which was partly linked to shipping delays.

Sub-contractor charges increased at an accelerated pace in January, with the rate of inflation hitting a 21-month high. This was despite a reduction in sub-contractor usage for the fifth time in the past six months. Construction firms meanwhile signalled renewed cutbacks to their staffing levels. Employment decreased for the first time since August 2024, but the rate of decline was only marginal.

Finally, around 38% of the survey panel predict a rise in business activity over the year ahead, while only 17% forecast a reduction. However, this pointed to the lowest degree of business optimism since October 2023. Survey respondents cited a post-Budget dip in confidence among clients, alongside weakening sales pipelines and the impact of lacklustre domestic economic conditions.

S&P Global UK Construction PMI®

Comment

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

“UK construction output fell for the first time in nearly a year as gloomy economic prospects, elevated borrowing costs and weak client confidence resulted in subdued workloads.

“Output levels decreased across the board in January, with particularly sharp reductions seen in the residential and civil engineering categories.

“Construction firms noted the fastest fall in residential work for 12 months as market conditions remained somewhat subdued. Anecdotal evidence suggested that caution regarding demand for new projects was prevalent at the start of 2025, despite strong policy support for house building and hopes for a longer-term boost to supply via planning reform.

“The forward-looking survey indicators were also relatively downbeat in January. New orders decreased at the fastest pace since November 2023 amid many reports of delayed decision-making by clients. Reduced workloads, combined with concerns about the general UK economic outlook, led to a dip in business activity expectations to the lowest for 15 months.

“There was little respite on the supply front, as transport delays meant that vendor lead times lengthened to the greatest extent for two years. Demand for construction items softened again in January, but purchase price inflation was the highest since April 2023 as suppliers sought to pass on rising energy, fuel and wage costs.”

Josh Ward-Jones, director of Bloom Building Consultancy, commented:

“The warning lights on the construction industry dashboard have switched from amber to red.

“In fact there’s precious little to cheer about in January’s PMI data, which shows a clean sweep of negative trends. Both output and orders are down, cost pressures are rising and sentiment is sliding.

“For much of 2024, the weakness of the housebuilding sector was offset by the buoyancy of commercial construction. No longer. January’s headline figure slipped into contraction territory for the first time since last February.

“The pipeline of new work is starting to get patchy too. While the decline in new orders was modest, as the first reversal in 12 months it cannot be dismissed as inconsequential.

“Many are blaming the slowdown in demand on the hit to business confidence seen in the wake of last October’s Budget. Companies worried about their business prospects and the impact of April’s jump in Employer NI Contributions have been quick to pause or rein in capital spending.

“This slowdown is being reflected in construction firms’ sentiment too. The PMI survey found that just 38% of contractors expect business activity to increase over the next year – the lowest level since October 2023. As recently as a month ago, the figure stood at almost half.

“Yet while there has been a cooling in new construction work, demand for refurbishment and upgrade work remains brisker. And though cost pressures are eating into contractors’ margins, the Bank of England could offer some relief later today if it cuts interest rates as expected.

“Cheaper finance costs would be a welcome salve for an industry which has made a fragile and cautious start to 2025.”

Jordan Smith, technical director at Thomas & Adamson, part of Egis Group, said:

“The overall construction PMI reading falling into negative territory for the first time in nearly a year is not unexpected – accelerating cost inflation, weaker economic conditions, and higher borrowing costs have slowed the sector’s recovery. And, despite policy support for the likes of housebuilding and civil infrastructure, these are seeing some of the weakest levels of activity on the ground.

“Still, we expect to see further detail about the government’s spending plans in the coming months and would hope that this will provide much-needed stimulus to the sector – particularly areas that have struggled recently. It is also worth noting that, on balance, more firms continue to predict a rise in activity during 2025 than a fall.

“Similarly, we have experienced a strong start to 2025, with a pipeline of projects emerging throughout the year across various sectors. So, while the short-term picture remains a little unclear, there are good reasons to remain optimistic about the medium and long-term”

Leave a Reply

Want to join the discussion?Feel free to contribute!