COMPLEXITIES OF UK ENERGY PROCUREMENT

Chris Goggin observes how the UK procures its energy and the complexity in which it is then distributed and reacquired. As the UK progresses towards NetZero Rinnai looks to assist the industry in understanding what roles specific energies will fulfill and what approach the UK utilizes towards both the national and international energy markets.

Chris Goggin observes how the UK procures its energy and the complexity in which it is then distributed and reacquired. As the UK progresses towards NetZero Rinnai looks to assist the industry in understanding what roles specific energies will fulfill and what approach the UK utilizes towards both the national and international energy markets.

UK domestic energy procurement and distribution is a complex process that is reliant on a number of separate countries, huge commercial enterprises and separate forms of energy. The UK currently imports and cultivates energy from a tangled mass of outlets and prime suppliers. For example, we have electricity from interconnectors held by Belgium, Denmark and The Netherlands, LPG from America as well as the extraction of Norwegian North Sea natural gas and oil.

UK Electrical power company Drax has recently issued a statement on its website stating in their headline:

“UK Spends £250 million each month Importing Record Volumes of Electricity from Europe.”

This means that 20% of the UK’s monthly electrical energy requirements are wholly reliant on outside influence.

Extensive outside ownership heavily contributes towards meeting the UK’s power demand: one of the UK’s largest energy suppliers is Scottish power who distribute gas and electricity to over 5 million private households and commercial premises. Scottish Power is a subsidiary of global Spanish energy company Iberdrola.

State owned French electrical company EDF accounts for 18.5% of total UK market share in wholesale electrical generation. In 2023 EDF’s nuclear facilities provided around 13% of the UK’s total power demand. EDF supply energy to over 5 million UK customers.

Additional layers of complexity within the UK energy market become prevalent once scrutinised. Not all oil and gas extracted from UK North Sea territory is owned by UK companies but by private foreign investors. For example, the Rosebank oil field is owned by Norwegian state enterprise – Equinor. Norwegian gas reserves were responsible for satisfying 58% of the UK’s gas demand during 2023.

Online non-partisan energy news outlet, Energy Monitor released a story in January 2024 stating that at least 40% of oil and gas licenses in the UK North Sea oil and gas fields were passed on to foreign investors.

Any profits earned by the investors do not enrich the UK treasury nor do investors have to follow NetZero guidelines; and any energy extracted from UK territory can be immediately sold on the open market to any bidder – NOT direct to the UK.

So, energy extracted in the UK by foreign investors is occasionally purchased by the UK government from the international market. To add further confusion to this scenario, UK companies that also acquire gas from home waters export 46% of their product to other countries. UK Domestic demand is ignored in favour of making bigger profits from the international energy market by UK companies.

International geopolitics heavily influences global energy prices and distribution routes as well as highlighting the commercially driven nature of the global energy market. The Ukrainian / Russian war exposed Shell for buying Soviet gas at cheap prices despite their being international financial sanctions placed on Russia. Shell continues to work with Russia due to preset contractual agreements.

As the intricacies of the present international energy market are complex and confusing, the UK is moving towards clean renewables that are not subject to cost spikes nor interfering geopolitics that beset fossil fuels. In 2023 the UK energy mix consisted of 36.7% renewables. In 2024 that share has increased to 43.1%.

The current plan by the UK government is to increase naturally sourced energy extraction such as solar and wind power and to eventually cease fossil fuels. UK oil and gas usage has discernibly dropped over the last decade, in 2014 the UK’s energy mix included 58.1% of fossil fuels – in 2023 that number has dropped to 32.2%.

The UK government is particularly keen on introducing an age of cheap and clean electrical power and has very recently publicly released a document entitled:

“Clean Power 2030 Action plan: A New Era of Clean Electricity.”

This governmental report details the UK government’s ambition of fueling UK domiciles and commercial properties with green electricity at low cost.

This document also provides further objectives in adding clean power to the UK national grid. Renewables will increasingly play a huge role in the UK domestic energy mix; the UK government aims to increase overall and individual capacity of renewably sourced power. Offshore wind will be increased to 43 – 50GW, onshore wind will be expanded to 27-29GW, whilst solar power capacity will also be increased to 45 – 47GW.

A move towards renewables means that UK domestic energy security is strengthened whilst NetZero targets can be met whilst customer costs will lower in time. Modern energy extraction and distribution is a complex process driven by geopolitics and corporate commercial ambition. By expanding renewable capacity, the UK aims to reduce reliance on outside influences and to cease operating as a net importer of energy.

However, the UK approach to energy cultivation and distribution is heavily reliant on external players who do not necessarily have to abide by UK rules and regulations. Huge companies such as EDF and Scottish Power will have to follow instructions passed down by foreign organizations, a process that could harm the validity of domestic energy security and customer cost control.

Rinnai will continue to monitor global energy issues and deliver non-bipartisan news items that best represent the current machinations of the international energy market. Any change in legislation or market conditions that may affect product and energy options will be shared accordingly.

RINNAI OFFERS CLEAR PATHWAYS TO LOWER CARBON & DECARBONISATION

PLUS CUSTOMER COST REDUCTIONS FOR COMMERCIAL, DOMESTIC &

OFF-GRID HEATING & HOT WATER DELIVERY

- Rinnai’s range of decarbonising products – H1/H2/H3 – consists of hot water heating units in gas/BioLPG/DME, hydrogen ready units, electric instantaneous hot water heaters, electric storage cylinders and buffer vessels, a comprehensive range of heat pumps, solar, hydrogen-ready or natural gas in any configuration of hybrid formats for either residential or commercial applications. Rinnai’s H1/2/3 range of products and systems offer contractors, consultants and end users a range of efficient, robust and affordable low carbon/decarbonising appliances which create practical, economic and technically feasible solutions.

- Rinnai is a world leading manufacturer of hot water heaters and produces over two million units a year, operating on each of the five continents. The brand has gained an established reputation for producing products that offer high performance, cost efficiency and extended working lives.

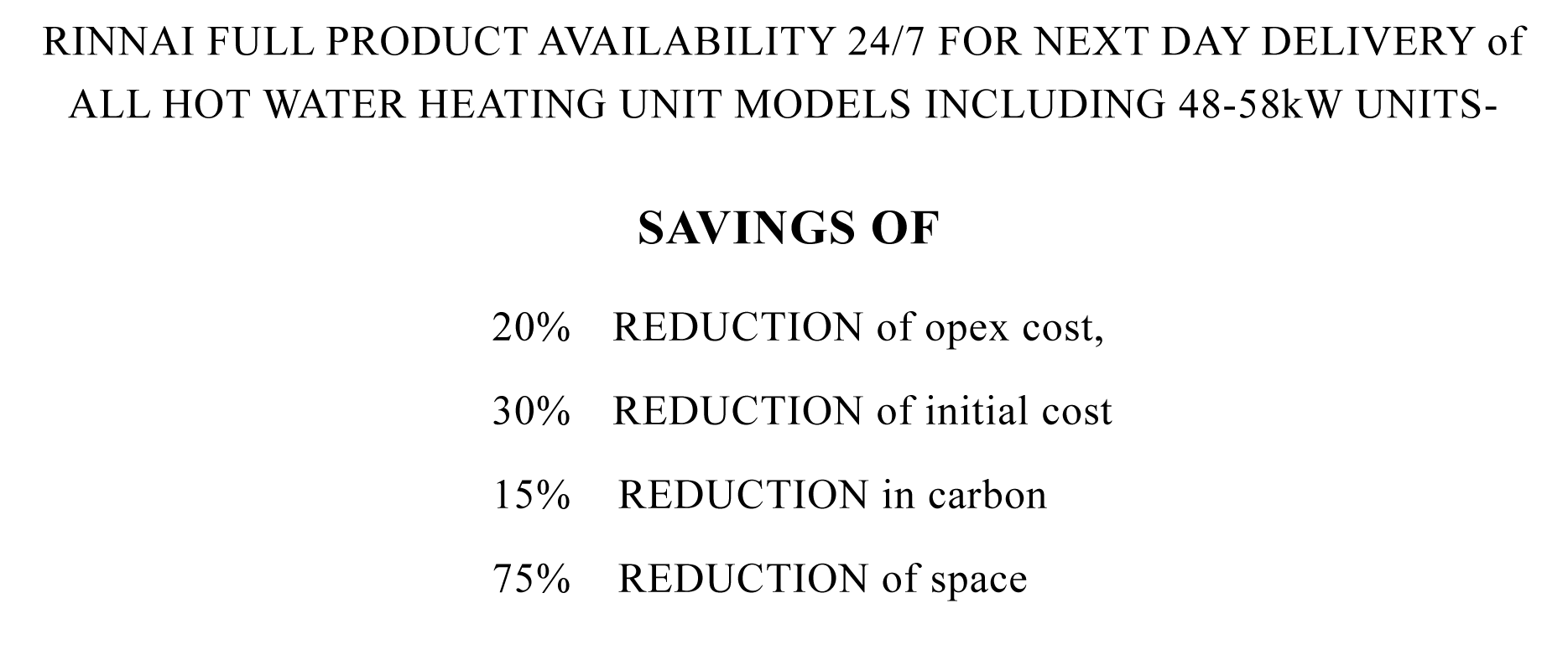

- Rinnai products are UKCA certified, A-rated water efficiency, accessed through multiple fuel options and are available for purchase 24/7, 365 days a year. Any unit can be delivered to any UK site within 24 hours.

- Rinnai offer carbon and cost comparison services that will calculate financial and carbon savings made when investing in a Rinnai system. Rinnai also provide a system design service that will suggest an appropriate system for the property in question.

- Rinnai offer comprehensive training courses and technical support in all aspects of the water heating industry including detailed CPD’s.

- The Rinnai range covers all forms of fuels and appliances currently available – electric, gas, hydrogen, BioLPG, DME solar thermal, low GWP heat pumps and electric water heaters More information can be found on Rinnai’s website and its “Help Me Choose” webpage.

CLICK HERE TO VISIT THE RINNAI WEBSITE

or HERE to EMAIL RINNAI

CLICK HERE For more information on the RINNAI product range

Leave a Reply

Want to join the discussion?Feel free to contribute!