Higher Borrowing Costs Curtail Construction Activity

S&P Global / SIPS UK Construction PMI®

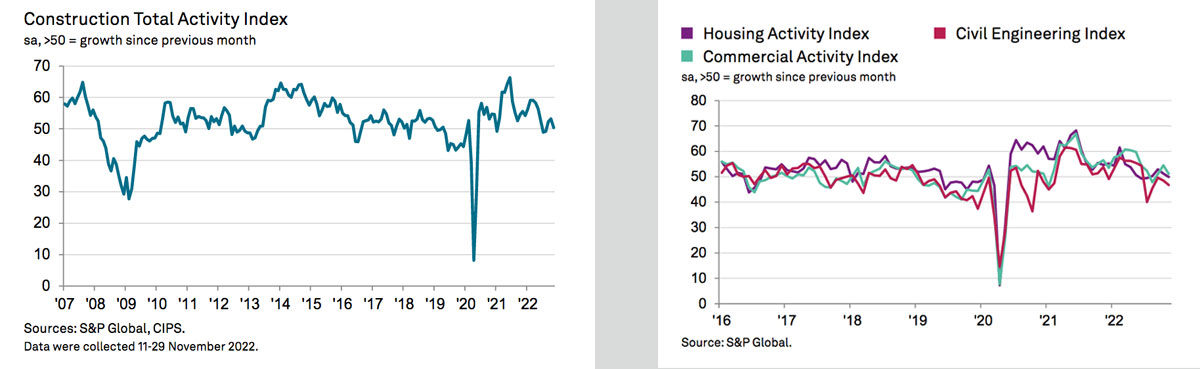

Growth slips to a three-month low. Business expectations weakest since May 2020.

UK construction companies signalled a renewed slowdown in business activity growth during November, reflecting subdued demand and reduced risk appetite among clients. A number of survey respondents noted that higher borrowing costs and worries about the economic outlook had curtailed construction activity.

Moreover, expectations for business activity growth during the year ahead continued to slide in November, with optimism the lowest for two-and-a-half years. Aside from the levels seen at the start of the pandemic, the degree of positive sentiment was the joint-weakest since December 2008.

At 50.4 in November, the headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index®(PMI®) – which measures month-on-month changes in total industry activity – registered above the 50.0 no-change mark for the third month running. However, the index was down from 53.2 in October and pointed to the weakest performance since August.

Commercial work was the only segment to register an overall rise in business activity in November (index at 51.1). House building activity meanwhile stalled (index at 50.0), which ended at three-month period of marginal expansion. Construction companies often noted higher mortgage rates and falling consumer confidence as factors that had held back residential activity.

Civil engineering activity (46.7) declined for the fifth consecutive month. The latest reduction was the sharpest since August. Lower volumes of output were mainly linked to a lack of new work to replace completed projects.

November data pointed to modest increase in total new orders across the construction sector, which contrasted with a slight decline in October. However, the rise in new business intakes was much weaker than seen on average in the first half of 2022. Survey respondents often noted that weaker domestic economic conditions had acted as a headwind to client spending.

Employment numbers continued to increase in November, but the rate of job creation eased to its slowest since February 2021. Construction companies suggested that concerns about rising costs and weaker growth had led to more cautious hiring policies.

In contrast to the slowdown in staff recruitment, latest data signalled the fastest increase in input buying since July. Higher levels of purchasing activity were linked to rising workloads and improved raw material availability, although some cited efforts to place orders ahead of supplier prices hikes.

Average cost burdens increased sharply in November, which was linked to rising energy prices, tight supply conditions and general inflationary pressures. However, the overall rate of input cost inflation eased to its least marked since January 2021, partly due to softer commodity prices. Meanwhile, suppliers’ delivery times lengthened to the greatest extent since July. Survey respondents suggested that transport and logistics delays had led to longer wait times for the receipt of construction products and materials.

Looking ahead, around 29% of the survey panel anticipates a rise in business activity in 12 months’ time, while 26% forecast a decline. The resulting index signalled the lowest degree of confidence since May 2020. Anecdotal evidence suggested that recession worries, higher interest rates and a subdued housing market outlook had all weighed on optimism.

Comment

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “Stalling house building activity contributed to the weakest UK construction sector performance for three months in November. Survey respondents noted that new residential building projects had been curtailed in response to rising interest rates, cancelled sales and worries about the economic outlook.

“Construction growth was largely confined to the commercial segment, but even here the speed of expansion slowed considerably since October as client confidence weakened in response to heightened business uncertainty. At the same time, a lack of new work to replace completed projects resulted in another fall in civil engineering activity.

“The number of construction firms anticipating a rise in overall business activity during the year ahead exceeded those forecasting a decline by only a very fine margin during November. Moreover, disregarding a three-month period of negative sentiment at the start of the pandemic, our survey measure of business expectations across the construction sector was the joint-weakest since December 2008.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said:”The small uplift in activity in November did little to dispel builders’ fears about the future as optimism fell to the same level as December 2008 during the last recession and to one of the same lows seen during the pandemic.

“This gloomy view was fuelled in part by continuing shortages of key materials such as steel and timber along with skilled labour, affecting job hires which rose at the slowest pace since February 2021. As new order growth remained below the 2022 average to date, builders were becoming hesitant about hiring too many labourers and there was some mention of shedding jobs over fears of the strength of the economy in 2023.

“Overall, it was civil engineering that remained steadfastly stuck in the mud, with the fastest fall in activity since August. Client hesitancy, concerns around the cost of materials and doing business weighed heavily on the sector which recorded the fifth consecutive monthly fall in activity. Residential building also appears to have run out of steam as greater borrowing costs continue to dampen demand.

“Purchasing activity remained buoyant as businesses concerned about higher costs and potential delays reportedly ordered more than they needed, with delivery times increasing for the fourth consecutive month. Construction companies now have a tightrope to walk in terms of being ready for recovery and cautious around investment until the road is clear for sustainable building opportunities ahead.”

Leave a Reply

Want to join the discussion?Feel free to contribute!